Hey there! Dealing with credit card debt can feel like a bit of a rollercoaster, but don’t worry, you’ve got options! Ever heard of debt consolidation? It’s like bundling up all your debts into one manageable package. And there are other strategies too, like chatting with your creditors about new payment plans or seeking help from credit counselors who are like financial guides.

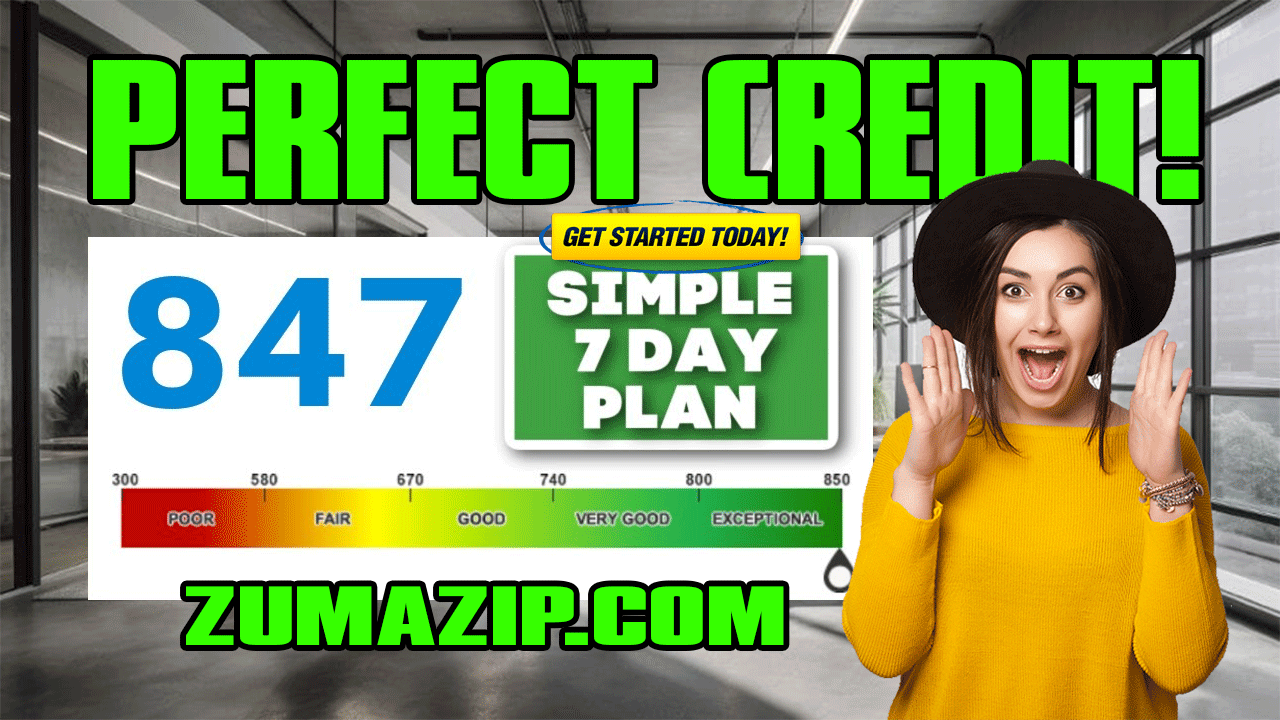

Oh, and here’s a cool one: ZumaZip Settle! It’s a tech-savvy way to tackle debt. They jump in and chat directly with your creditors to help settle debts, no matter how big or small. It’s like having a superhero negotiate on your behalf! So, hang in there – there are solutions out there to lighten the load.

US consumers owe $1.13 trillion in credit card debt. That’s a whole lot of money.

It’s true, the amount of credit card debt in the US is staggering! But don’t let that get you down. Having a credit card can actually be pretty handy if you’re on top of things. Yet, when that debt starts piling up, it can feel like a never-ending cycle.

But fear not! There are ways out of this maze of debt. One option is to break down your repayment plan into manageable steps. Maybe you set a goal to pay off a certain amount within a short timeframe. Or, if you’re feeling bold, you could consider taking out a new loan with better terms to wipe out that credit card debt all at once.

In our article, we tackle a question that’s on many folks’ minds: “How do I get rid of credit card debt fast?” We’ve put together five awesome strategies to help you kiss that debt goodbye and reclaim your financial freedom. So let’s dive in and get you back on track!

Debt consolidation can be a game-changer when it comes to managing your debts. It’s like tidying up your financial clutter by combining all those high-interest debts into one with better terms. Here’s how you can do it:

- 0% Balance Transfer Credit Card: This might sound a bit odd, but bear with me. You can snag a new credit card that offers a sweet 0% introductory period, usually lasting 12 to 18 months. Then, you transfer all your other credit card debts onto this new card. Voila! Suddenly, you’ve wiped out those pesky old debts and are left with just one card to manage, with much friendlier payment terms. But here’s the catch: make sure you pay off the balance within that intro period. If not, you might find yourself facing a higher interest rate than you started with. It takes some serious discipline, especially if money’s tight, to avoid racking up new debt while you’re trying to pay off the balance transfer.

- Fixed-Rate Personal Loan: Similar idea, different approach. With this method, you take out a personal loan to cover all your existing debts. Personal loans usually require decent credit and might come with a higher interest rate compared to those tempting credit card offers. However, the upside is that personal loans generally have more favorable interest rates than credit cards. Before you make any moves, though, it’s smart to use a debt consolidation calculator to figure out how much you could save by consolidating your debts this way.

So there you have it! Two nifty ways to consolidate your debts and simplify your financial life. It’s all about finding the approach that works best for you and your wallet.

Creating a new payment plan can be a lifesaver when you’re feeling overwhelmed by debt. Here’s how it works:

- Talk to Your Creditors: Believe it or not, creditors are often more flexible than you might think. They understand that sometimes life throws curveballs, and they’re usually open to discussing how they can help you make payments. If they sense that you might not be able to pay at all because of a tough financial situation, they might be willing to negotiate new payment terms.

- Hardship Programs: Many creditors offer hardship programs for folks facing tough times. These programs can lower your interest rate or waive certain fees for a set period, usually three months or more. Hardships can include things like unemployment, illness, disability, or even natural disasters. So if you’re wondering how to tackle credit card debt when you’re strapped for cash, a hardship program could be just what you need. It’s like hitting the pause button on your debt while you get back on your feet.

And hey, if those pesky creditors are blowing up your phone multiple times a day, you’ve got options. Our Debt Validation Letter can help put a stop to those calls so you can focus on finding your way out of debt without all the interruptions.

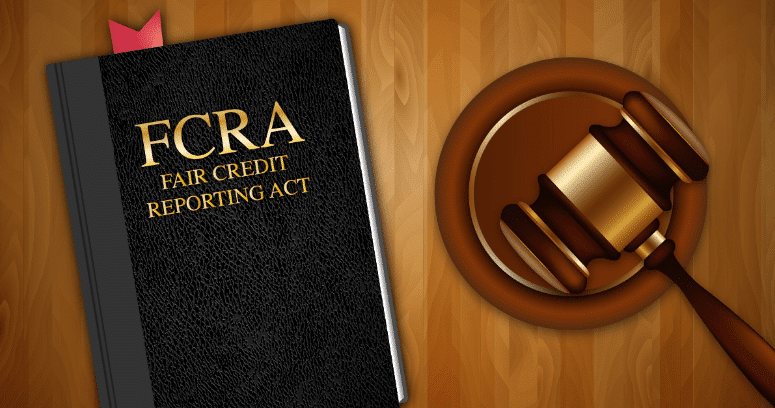

Settling your debt for less than the original amount can be a game-changer when you’re feeling overwhelmed. Here’s how it works:

- Debt Settlement: This nifty strategy lets you pay off your debt for a fraction of what you originally owed. How? By making a settlement offer to your creditors or the debt collection agency. You propose to pay a portion of the debt in one lump sum, and if they accept, you clear the balance. It’s like finding a shortcut out of debt town!

- DIY or Professional Help: You’ve got options here. You can take the DIY route and negotiate the settlement yourself. Or, if you’d rather have a pro handle it, there are credible debt settlement companies out there ready to lend a hand. These companies can take over the negotiation process, dealing with creditors and collectors on your behalf while you keep making payments into an account they help you set up.

- Life Happens: Here’s the thing – most creditors and collection agencies are surprisingly open to settling debts, especially if you’ve hit a rough patch due to unexpected life events like health issues, the loss of a loved one, or losing your job. It’s like they understand that life can throw some serious curveballs sometimes.

So if you’re thinking about settling your debt, don’t hesitate to explore your options. It could be the ticket to getting your finances back on track and waving goodbye to that debt for good.

To settle your debt, follow these simple steps:

- Validate the debt. Before you offer to settle, be sure the debt is accurate and yours.

- Make an offer. Determine how much you can afford to pay, and contact the creditor, debt collector, or attorney (if you’ve been sued) to communicate your first offer.

- Negotiate. You might have to go through a few rounds of negotiating before you come to an agreement.

- Get the settlement agreement in writing. You’ll want this for future proof that the debt was settled and your account was closed.

Working with a credit counselor can be a smart move if you’re feeling stuck in a financial rut. Here’s what they can do for you:

- Financial Checkup: Think of a credit counselor as your personal finance guru. They’ll sit down with you and dive deep into your finances to figure out what’s been tripping you up. Together, you’ll identify the challenges you’re facing and come up with a game plan to tackle them.

- Debt Management Plan: Once you’ve got a clear picture of where you stand, your credit counselor will help you craft a debt management plan. This plan is like your roadmap to financial freedom, outlining how you’ll pay off your debts and manage your budget along the way.

- Negotiation Magic: Ever wish you had a superhero who could swoop in and negotiate with your creditors on your behalf? Well, your credit counselor might just be that hero! They’ll reach out to your creditors, explain your situation, and try to wrangle better payment terms for you.

Now, here’s the thing: working with a credit counselor isn’t a quick fix. Most programs take a few years to help you pay off your debts, depending on your financial situation. But hey, slow and steady wins the race, right?

One important tip: be sure to choose a credit counselor wisely. Sadly, there are some shady characters out there looking to take advantage of folks in tough spots. To make sure you’re in good hands, check out the list of credible and approved credit counseling agencies compiled by the U.S. Trustee Program. They’ve got your back!

If you’re itching to break free from credit card debt ASAP, you’ll love these payment strategies. Check ’em out:

- Debt Snowball Method: Picture rolling a tiny snowball down a hill. It starts small, but as it rolls, it picks up more snow and gets bigger and bigger, right? That’s the idea behind the debt snowball method. You start by paying off your smallest debt first, then take that payment and add it to the next smallest debt. It’s like a snowball effect! By focusing on one debt at a time and snowballing your payments (while still making minimum payments on your other cards), you could shave years off your debt payoff time. Plus, seeing those smaller debts disappear can be a serious morale boost!

- Debt Avalanche Method: Imagine you’re climbing a mountain of debt, and you’re starting with the biggest, toughest peak first. That’s the debt avalanche method. You tackle the debt with the highest interest rate first, then move on to the next highest, rolling the payment you were making on the first debt into what you can now pay on the next one. This method might save you more money in the long run compared to the snowball method, but it takes a little longer to see those smaller debts vanish.

No matter which method you choose, the key is to focus on paying off one debt at a time. It’s like giving yourself little victories along the way, which can keep you motivated to keep chipping away at that debt mountain. You’ve got this!

Paying off credit card debt with ZumaZip Settle is a breeze! Here’s how it works:

- Tech-Powered Solution: ZumaZip Settle harnesses the power of technology to streamline the debt settlement process. No more endless phone calls or paperwork – everything happens online, quickly and efficiently.

- Direct Negotiation: ZumaZip Settle cuts out the middleman by negotiating directly with your creditors on your behalf. This means you don’t have to deal with the hassle of negotiations yourself – they’ve got it covered!

- Any Debt Size: Whether you’ve got a small debt or a hefty one, ZumaZip Settle can handle it. They’re equipped to negotiate settlements for debts of any size, giving you peace of mind that your financial situation is in good hands.

- Privacy and Legal Defense: Your privacy is top priority with ZumaZip Settle. They ensure confidentiality throughout the process, and if any legal issues arise, their parent company ZumaZip provides legal defense – so you’re covered every step of the way.

- Efficiency and Support: Unlike some other debt settlement companies out there, ZumaZip Settle is known for its proactive approach and stellar customer support. They’re with you from start to finish, making sure the process is smooth sailing.

With ZumaZip Settle, you can say goodbye to credit card debt stress and hello to financial freedom in no time!