Force your Lawsuit

Out of Court!

Sued for credit card OR Medical debt?

A Motion to Compel Arbitration makes it easy to win your case.

100% money-back guarantee

ZumaZip has garnered extensive coverage, featured in over 1200 news articles, showcasing numerous satisfied clientele attaining superior outcomes. With ZumaZip, clients navigate debt disputes swiftly and effectively, capitalizing on our comprehensive suite of service

Increase the pressure on the collector.

The Motion to Compel Arbitration will likely cause concern for the collector, given the potential outcome of the collector losing the case.

Save thousands of dollars.

Consider the potential for substantial savings by compelling the collector to arbitrate or dismiss the case.

Stop the collectors.

Upon receipt of a Motion to Compel Arbitration, debt collectors often cease their collection efforts on the debt in question.

How it works

1. You get sued for a debt that includes an arbitration clause within the agreement.

2. You respond to a few questions on our website to finalize the Motion process.

3. File you Motion

ZumaZip solution

Submitting your Motion will raise the debt collector's expenses associated with debt collection,

potentially leading to their decision to abandon pursuit.

A Motion to Compel Arbitration is the Best Move

Sued for credit card debt? Our Motion to Compel Arbitration is a powerful document that makes it easy to win your case. The Motion to Compel Arbitration is a document sent by someone being sued for debt to their debt collector. If your credit card or loan agreement includes an arbitration clause, our document is likely a great option for you.

You may want to file a Debt Answer first if you are considering a Motion to Compel Arbitration.

Begin Your Solution Today: Just 15 Minutes to Take Control.

A Motion to Compel Arbitration is the Best Move

Sued for credit card debt? Our Motion to Compel Arbitration is a powerful document that makes it easy to win your case. The Motion to Compel Arbitration is a document sent by someone being sued for debt to their debt collector. If your credit card or loan agreement includes an arbitration clause, our document is likely a great option for you.

You may want to file a Debt Answer first if you are considering a Motion to Compel Arbitration.

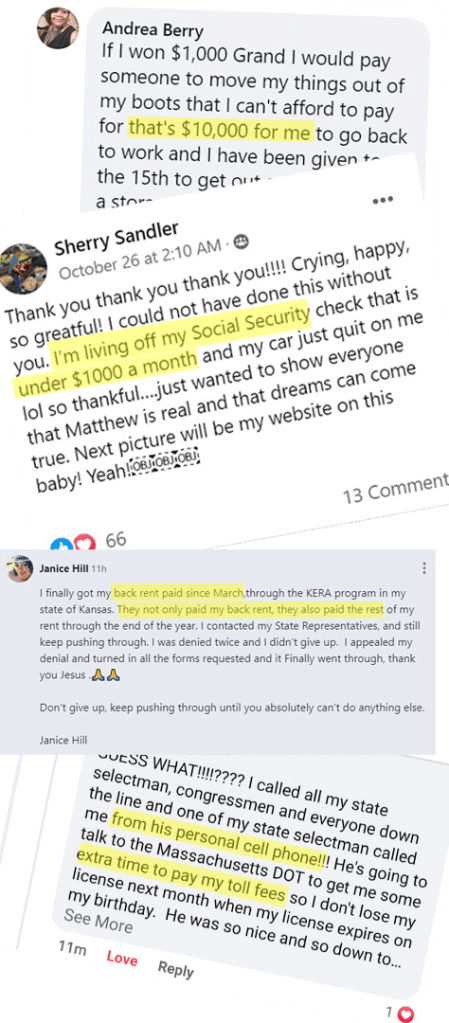

Look what People say who Zipped through Debt Disputes

Here Is the ZumaZip Guarantee

We assure your satisfaction with our services at ZumaZip, maintaining a commitment to excellence in litigation preparation support. Should you find any aspect of our services unsatisfactory, please reach out to us promptly for resolution or a refund. It’s important to note, however, that while we strive to provide exemplary support, we cannot guarantee the specific outcome of your legal proceedings. Instances such as an unfavorable court decision following the filing of your Answer are outside our purview and not covered under this guarantee. We appreciate your understanding of these limitations.

Over $1 Billion

PROTECTED

Over 200,000+

PEOPLE LIKE YOU HELPED

Frequently Asked Questions:

This Motion to Compel Arbitration is for you if you’ve been sued for a debt and the original contract for the debt includes an arbitration clause.

Monika has been sued for a $7,000 debt by Debt Collectors, LLC. The debt is a credit card debt from Capital One. The credit card agreement has an arbitration clause in it. This clause says if the collector sues the debtor, the debtor can request the case be arbitrated, instead of going through court. So, Monika files a Motion to Compel Arbitration in the court. To continue with the lawsuit, the collector would have to pay a large fee to begin arbitration. The debt collector decides the debt is not worth the expense and stops pursuing the case.

No. At this time you need to file the Motion to Compel Arbitration yourself. We will provide some filing instructions.

Yes. The original contract for the debt must have an arbitration clause. For example, if the debt is a credit card debt, the credit card agreement must have an arbitration clause in it.

Not really. In most cases, a Motion to Compel Arbitration can be filed at any point in the case before a judgment is granted, or someone loses. This varies from state to state and case by case. Generally, we find it best to file the Motion to Compel Arbitration right after filing an Answer.

Yes, this is a sample Motion to Compel Arbitration.

Increase your chances of winning

A Motion to Compel Arbitration increases the cost of the case for the collector and increases the likelihood the collector will drop the case.

Begin Your Solution Today: Just 15 Minutes to Take Control.

ZumaZip has your back

And we’ve got you covered in all 50 states.