Continue forward

with your life.!

Stop debt collectors in their tracks with our Debt Validation Letter. It legally requires them to validate the debt they claim you owe. Don’t let intimidation tactics work – assert your rights today!

100% money-back guarantee

ZumaZip has garnered extensive coverage, featured in over 1200 news articles, showcasing numerous satisfied clientele attaining superior outcomes. With ZumaZip, clients navigate debt disputes swiftly and effectively, capitalizing on our comprehensive suite of service

Save thousands

Maximize your savings by paying only what is necessary, potentially even reducing your payment to zero.

Stop the harassment

Stop collectors' harassing you through incessant phone calls and letters.

Improve credit score

Enhance your credit score by compelling collectors to report disputed debts.

How it works

1. Receive communication from a debt collection agency by phone, email or mail.

2. Answer some simple questions on our website so you can properly respond to the debt collector.

3. We will finalize your letter, and you can proceed to mail it accordingly

ZumaZip solution

Upon receipt of your letter by the debt collector, they will be required to cease their actions

until they can provide you with proof of everything

Completing a Debt Validation Letter is the best course of action.

A Debt Validation Letter, sent by a consumer (You) to a debt collector, asserts rights under the Fair Debt Collection Practices Act (FDCPA). It demands proof of the debt’s validity, cessation of contact for any other purpose, and insistence on reporting the debt as disputed.

Many debt collectors will just give up after receiving a Debt Validation Letter.

Completing a Debt Validation Letter is the best course of action.

A Debt Validation Letter, sent by a consumer (You) to a debt collector, asserts rights under the Fair Debt Collection Practices Act (FDCPA). It demands proof of the debt’s validity, cessation of contact for any other purpose, and insistence on reporting the debt as disputed.

Many debt collectors will just give up after receiving a Debt Validation Letter.

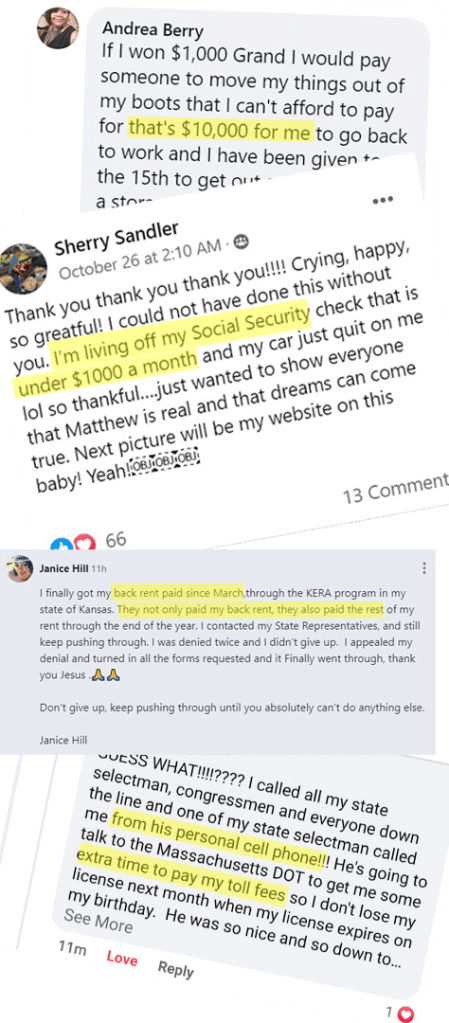

Look what People say who Zipped through Debt Disputes

Here Is the ZumaZip Guarantee

We assure your satisfaction with our services at ZumaZip, maintaining a commitment to excellence in litigation preparation support. Should you find any aspect of our services unsatisfactory, please reach out to us promptly for resolution or a refund. It’s important to note, however, that while we strive to provide exemplary support, we cannot guarantee the specific outcome of your legal proceedings. Instances such as an unfavorable court decision following the filing of your Answer are outside our purview and not covered under this guarantee. We appreciate your understanding of these limitations.

Over $1 Billion

PROTECTED

Over 200,000+

PEOPLE LIKE YOU HELPED

Frequently Asked Questions:

If you have received communication from a debt collector regarding debt collection but have not yet been sued for the debt, this Debt Validation Letter is tailored for your situation.

Franco received a phone call from Collections Company, informing him of an alleged $6,000 debt owed to Citibank. Subsequently, Franco hangs up the phone. Franco received a letter confirming the debt details 7 days later. In response, three days later, Franco mailed Collections Company a Debt Validation Letter from ZumaZip. Following this, Franco received a letter from Collections Company stating their inability to validate the debt and their decision not to pursue the matter anymore.

No. At this stage, you will need to personally mail the Debt Validation Letter. We can assist by generating the document for you.

Yes, Our Debt Validation Letter is crafted in accordance with the Fair Debt Collections Practices Act, specifically 15 USC 1692g §809. It is meticulously prepared by professional attorneys, rendering it the most potent Debt Validation Letter accessible in the market.

While the FDCPA stipulates that the consumer must notify the collector “within thirty days,” it does not explicitly outline the repercussions of sending the letter after this deadline. However, the letter may still hold influence, albeit diminished. In many instances, it is still worthwhile to submit the letter even if the deadline has lapsed.

Indeed, a Debt Validation Letter and a Debt Verification Letter are typically regarded as synonymous or in other words, the same thing. The FDCPA employs the terms “validate” and “verify” interchangeably. At ZumaZip, we refer to the letter sent by the consumer to the debt collector as the Debt Validation Letter, aligning with common usage.

Protect your rights and defend yourself effectively.

Respond promptly to a collection attempt within 30 days by sending a Debt Validation Letter. Defending yourself can be accomplished in just five minutes.

Begin Your Solution Today: Just 15 Minutes to Take Control.

ZumaZip has your back

And we’ve got you covered in all 50 states.