If you’re sued for a debt and the collector violated the FDCPA, use ZumaZip to respond in 15 minutes and win your lawsuit.

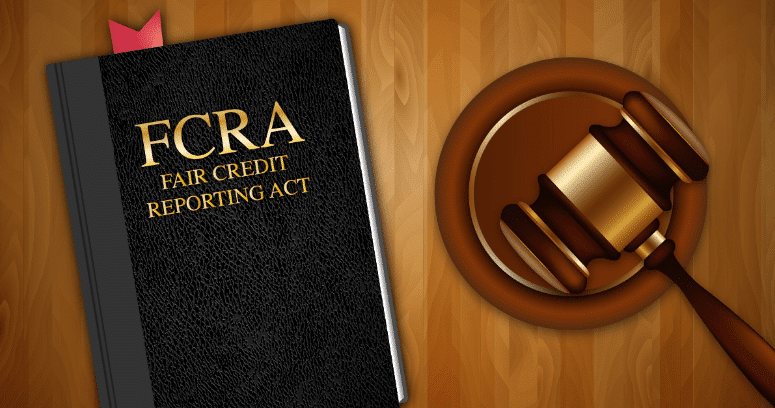

Debt collectors are known for being aggressive, rude, and even threatening in their efforts to try and get someone to repay an alleged delinquent account. It is important to understand that you do not have to put up with harassing or threatening phone calls, letters, social media posts, and so forth. In fact, you have certain protections from overly aggressive debt collectors through the Fair Debt Collection Practices Act (FDCPA). The FDCPA is a federal law enacted by Congress specifically to protect individuals from being subjected to unethical and abusive debt collection efforts. Unfortunately, despite the protections afforded under the FDCPA, some debt collectors ignore the law and use unethical tactics in the hopes that individuals remain unaware of the protections available under this federal law.

Below is an overview of certain tricks and tactics debt collectors are prohibited from using while contacting people. Knowing what a debt collector can, and cannot, do is important for many reasons, including the ability to potentially pursue compensatory damages through a civil claim if a debt collector violates the FDCPA.

Debt Collectors Cannot Harass You

Debt collectors are not allowed to harass you or your loved ones. For example, debt collectors are expressly prohibited, pursuant to the FDCPA, from engaging in these actions:

- Threatening to harm you or members of your family physically

- Threatening to harm you or members of your family financially

- Using obscene or profane language during phone calls or other correspondence

- Calling you repeatedly

- Calling you prior to 8:00 a.m. or after 9:00 p.m. without your permission

- Calling you at work

Debt Collectors Cannot Pretend to Work for a Government Agency

Debt collectors are prohibited from pretending to work for a government agency like the IRS, FBI, or any other agency. In addition, debt collectors are prohibited from claiming that they work for a consumer reporting agency.

Debt Collectors Cannot Threaten to Have You Arrested

Debt collection companies are prohibited from falsely claiming that you committed a crime or threaten to have you arrested if you fail to repay the amount allegedly owed.

First and foremost, debt collectors cannot issue arrest warrants or have you put in jail. Second, if someone fails to repay credit card debt, a car loan, or a medical bill is not a criminal offense.

Debt Collectors Cannot Publicly Shame or Embarass You

Debt collectors are prohibited from trying to publicly shame you into paying money that you allegedly owe. For example, they cannot publish the names of people who owe money and they cannot discuss the alleged debt with anyone other than you, your spouse, or your attorney.

Debt Collectors Cannot Attempt to Collect a Debt That You Do Not Actually Owe

It is surprisingly common for a debt collector to pursue an outstanding debt from the wrong person. This oversight happens because a creditor may have sold, or even re-sold, the debt to a collection agency, which in turn may have sold it to another collection agency. The multiple sales and transfers of debts often lead to administrative errors, including the wrong person being identified as the alleged debtor. This is why it is so important to demand Information about the alleged debt to confirm that you are the person who actually owes the debt.

Within five days of first contacting you, a debt collector is required to send you a written notice that expressly states the following:

- The amount you owe

- To whom you owe

- How to make your payment.

If you aren’t sure whether you owe a debt, send a letter to the collector via certified mail with a return receipt asking for more information. Make sure you do not assume any responsibility for the alleged outstanding debt. If you need assistance in drafting this type of letter, utilize the resources and information available through ZumaZip.

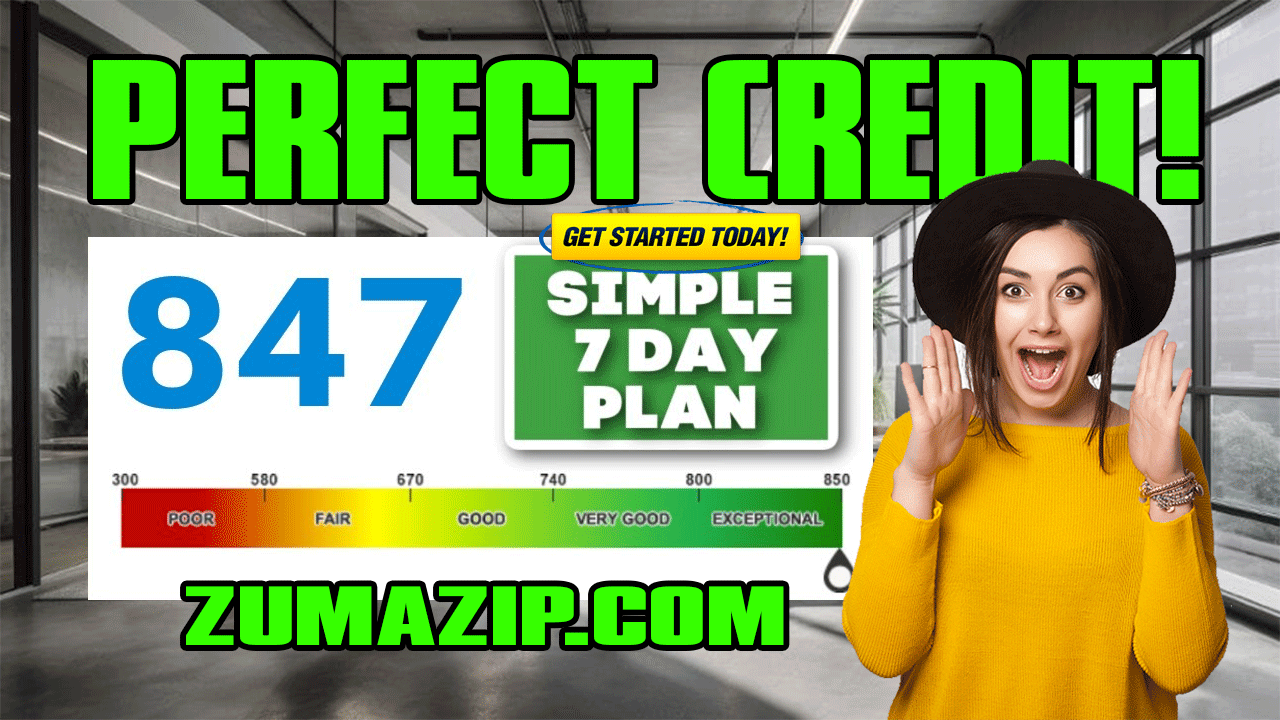

What is ZumaZip?

ZumaZip makes it easy to respond to a debt collection lawsuit.

How it works: ZumaZip is a step-by-step web-app that asks you all the necessary questions to complete your answer. Upon completion, you can either print the completed forms and mail in the hard copies to the courts or you can pay ZumaZip to file it for you and to have an attorney review the document.

ZumaZip is a handy tool designed to help you handle a debt collection lawsuit with ease.

Here’s how it works: ZumaZip guides you through each step of the process via a simple web application. It asks you all the important questions needed to complete your response. Once you’re done, you have two options. You can either print out the finished forms and mail them to the courts yourself, or you can opt to have ZumaZip handle the filing for you, along with the added bonus of having an attorney review your document.

Overview of the Protections Provided by the FDCPA

Here is a summary of the protections and rights afforded to you under the FDCPA.

- Debt collectors cannot harass you

- Debt collectors cannot threaten to arrest you

- Debt collectors cannot mislead you and say they are contacting you on behalf of a federal agency

- Never assume responsibility for the alleged amount owed

- Make sure to request information about the alleged debt from the company to ensure you actually owe the debt.