Exactly! An affirmative defense is a legal argument a defendant presents to prove they are not responsible for the alleged debt. In a debt collection lawsuit, these defenses outline reasons why the defendant shouldn’t be held liable for the debt. It’s crucial to include these defenses when responding to the lawsuit.

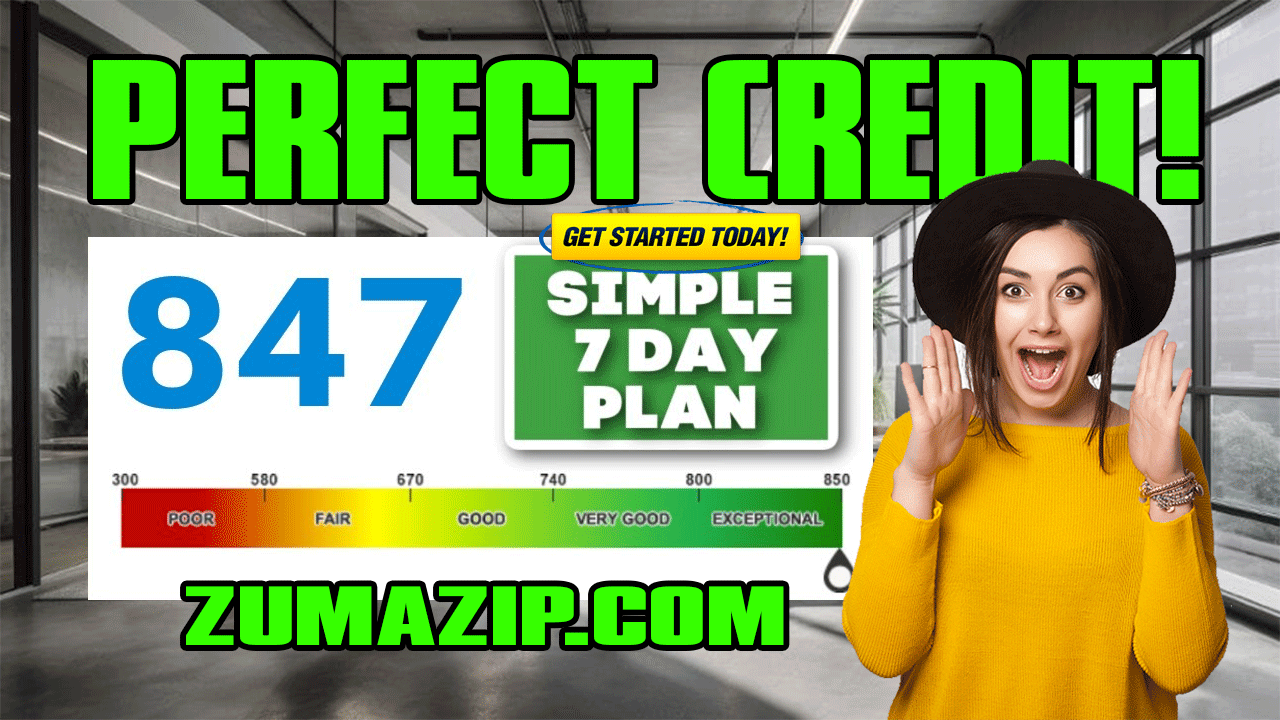

And that’s where ZumaZip comes in handy! With ZumaZip, you can ensure you’re using the right defense effectively. It guides you through the process, helping you to present your defenses accurately and efficiently.

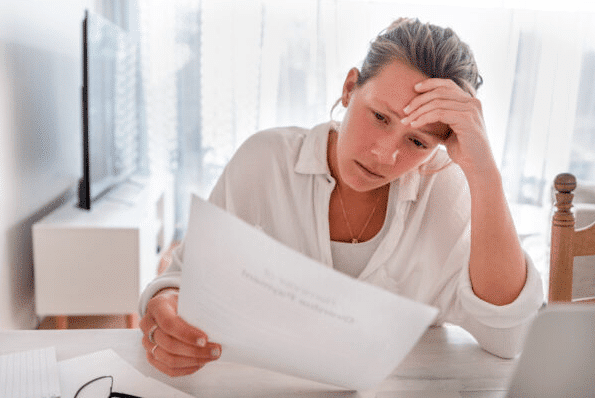

Receiving notice of a lawsuit for an old debt can definitely be unsettling. It’s natural to feel a bit anxious about it. After all, nobody wants to find themselves in a legal dispute.

Once you’ve had a chance to review the lawsuit and understand who the plaintiff (the person or company suing you) is, it’s important to decide how to respond. You have a few options: you can try to pay off or negotiate the debt before the court date, you can choose to ignore the lawsuit (though this isn’t recommended), or you can defend yourself in court. Each option comes with its own considerations, so it’s essential to carefully weigh your choices before deciding how to proceed.

Deciding whether to pay off or negotiate your debt before the court date has its perks. It allows you to resolve the liability and move forward without the worry of a potential judgment hanging over you. Conversely, ignoring the lawsuit can lead to a default judgment, forcing you to pay the debt with possible legal repercussions, such as wage garnishment or bank account seizure.

Another option is to defend yourself in court. However, many people aren’t familiar with how to do this effectively in a debt collection lawsuit. Often, individuals assume they have no defense because they technically owe the money.

But here’s the thing: that’s not necessarily true. You likely have several defenses available, known as affirmative defenses. In this article, we’ll delve into what affirmative defenses entail and which ones may be relevant in a debt collection lawsuit.

Ensure you choose the appropriate defense and present it effectively.

What is an affirmative defense in a civil case?

An affirmative defense in a civil case occurs when the defendant, the individual or entity being sued, presents arguments or evidence to demonstrate that they are not responsible or at fault. Put simply, it’s a legal rationale or justification for why the defendant shouldn’t be held liable in the lawsuit.

Here’s a quick recap on affirmative defenses, based on the interview with a real lawyer:

- Understanding Affirmative Defense: In civil cases like debt collection, an affirmative defense involves acknowledging the plaintiff’s claim while presenting a valid legal defense.

- Example: Statute of Limitations: The statute of limitations is a common affirmative defense in debt lawsuits. It varies by state and typically sets a time limit for creditors to sue after an account defaults. Even if the debt is valid, if the creditor sues after this period, the statute of limitations can be invoked as a defense.

- Importance of Statute of Limitations: It’s advisable to raise the statute of limitations defense, even if you’re unsure if it applies to your case. It’s a crucial protection and can significantly impact the outcome of the lawsuit.

- Private Arbitration as a Defense: Private arbitration, while not typically considered an affirmative defense, can still be used as a strategy in debt lawsuits. By requesting private arbitration, you signal the possibility of resolving the dispute outside the court system, which can be advantageous and may lead to a case dismissal or relocation out of court.

- Responding Prudently: In responding to complaints, it’s essential to address the claims directly, provide accurate information, and assert any relevant affirmative defenses, such as the statute of limitations. Even if uncertain, raising these defenses can safeguard your rights and potentially influence the case’s outcome.

In essence, a strategic and informed response to complaints, coupled with the assertion of relevant affirmative defenses, can play a crucial role in protecting your interests and achieving a favorable resolution in debt collection lawsuits.

Assert your affirmative defenses.

Affirmative defenses can be incredibly beneficial, even if you’re technically in the wrong. Here’s how they can help you:

- Dismissal of Lawsuit: If you can prove an affirmative defense, the judge may dismiss the lawsuit against you, regardless of your guilt.

- Shift of Burden of Proof: However, using an affirmative defense can be risky because it shifts the burden of proof to you. While the plaintiff typically needs to prove their case against you, if you use an affirmative defense, you must fully demonstrate its applicability.

- Effective Defense Strategy: Affirmative defenses can catch creditors and debt collectors off guard, as they often assume debtors won’t challenge them in court. Utilizing these defenses effectively can lead to a favorable outcome, such as a complete dismissal of your case.

Now, let’s explore some affirmative defenses commonly used in debt collection cases:

- Expired Statute of Limitations: If the statute of limitations for the debt has expired, you can argue that the creditor is no longer legally entitled to collect it.

- Identity Theft: You can claim that someone stole your identity and incurred the debt fraudulently.

- Payment Already Made: If you’ve already paid off the debt, you can assert this as a defense against the lawsuit.

- Lack of Business Relationship: If you have no established business relationship with the debt collector, you can dispute the validity of the debt.

- Bankruptcy Filing: If you’ve filed for bankruptcy, certain debts may be discharged, making them unenforceable in court.

- Improper Service of Process: You can challenge the validity of the lawsuit if you were not properly served with legal documents.

- Unauthorized User: If you’re being pursued for a debt you didn’t authorize or incur, you can dispute it as an unauthorized user.

- Altered Balance: If the debt collector has altered the balance of the debt, you can challenge the accuracy of the amount owed.

Understanding and utilizing these affirmative defenses can significantly strengthen your position in a debt collection case and potentially lead to a favorable outcome.

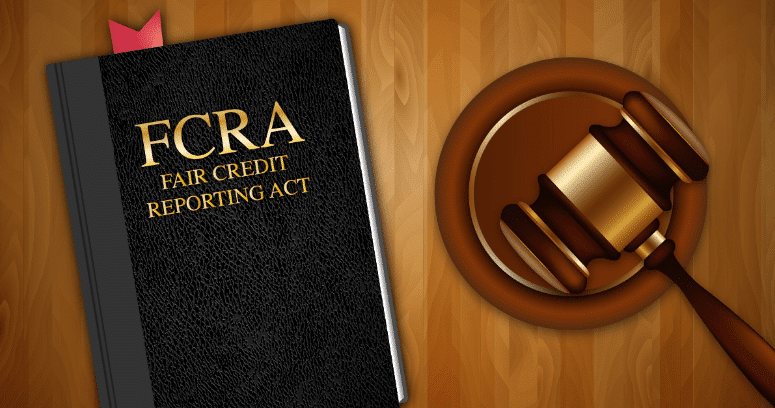

The statute of limitations is a crucial defense to consider when facing a debt collection lawsuit. Here’s why:

Each state sets a statute of limitations, which determines the timeframe during which creditors or collectors can legally pursue legal action on a debt. In simple terms, it’s like a deadline for suing someone for a debt.

The statute of limitations can vary based on the type of debt. For example, the timeframe for collecting debts from promissory notes (like car loans) may differ from that for revolving accounts (like credit cards).

Most states have statutes of limitations ranging from three to ten years. Kentucky, for instance, allows creditors up to fifteen years to file a lawsuit for certain types of debts, such as student loans, car purchases, or real estate transactions.

When dealing with debt collection, individuals typically interact with creditors and debt collectors. Debt collectors work for companies that buy old debts at reduced prices and attempt to collect them from the original borrowers. By the time a debt collector purchases your debt, several years may have passed, possibly resulting in the expiration of the statute of limitations.

Although the statute of limitations doesn’t prevent debt collectors from contacting you about the debt, it can stop them from winning a lawsuit against you. This defense is vital in protecting your rights and potentially avoiding legal consequences related to the debt.

Let’s dive into an example:

Example: Franklin is facing a lawsuit from a debt collector in California over an old credit card debt totaling $800. When Franklin learns about the case, he doesn’t even recall the debt. After some digging, he discovers that the debt account has been inactive for over six years. Considering that the statute of limitations on credit card debt in California is four years, the debt collector lacks the legal grounds to sue him for it. Franklin decides to use ZumaZip to create and file his Answer to the lawsuit. He includes the expired statute of limitations as one of his affirmative defenses. As a result, the case is dismissed.

In this scenario, Franklin effectively leverages the expired statute of limitations as an affirmative defense, ultimately leading to the dismissal of the lawsuit against him.

Use the statute of limitations as an affirmative defense to beat debt collectors in court.

2. Someone stole your identity

If you receive notice of an intent to sue for a debt you know nothing about, you may be the victim of identity theft.

Identity theft is, sadly, widespread. Criminals can find your personal details, like your Social Security number, name, and address, and use the information to obtain money from a lending institution.

Consumers are well-advised to keep a close eye on their credit reports and notify creditors if a new balance appears that isn’t theirs. However, not all consumers regularly check their reports, and sometimes the first time they notice something is amiss is when a debt collector attempts to sue them for the stolen money.

Individuals sued for a debt that isn’t theirs must follow the appropriate steps to report the theft and notify the debt collector. The debt collector cannot act against the individual unless the authorities find that identity theft did not occur.

3. You already paid off your debt

It’s rare for a debt collector to sue for a paid debt, but it does happen. Occasionally lines get crossed, and the creditor doesn’t update their files appropriately, resulting in a lawsuit for a debt you no longer owe.

In other cases, debtors pay off their liability before the court case date. If a collector receives full payment before the court date, they will need to dismiss their claims.

Sometimes, individuals may negotiate a payment plan or a reduced payoff before the court date. If your creditor agrees to a payment plan or settlement, make sure to obtain the arrangement in writing. You can use a copy of the agreement to have your case dismissed.

4. No business relationship exists with the debt collector

One intriguing affirmative defense is no business relationship between the debt collector and the consumer. This defense may work if the party suing you for a debt is not the original creditor.

To prove that no business relationship exists between you and the creditor, you must show that the original debt was with another lender, like a financial institution or bank. The defense strengthens if you show that the debt collector increased the original owed balance when they purchased the old debt.

5. You have filed for bankruptcy

Sometimes, people become so overwhelmed by debt they simply can’t foresee a way out. In such cases, they may file for bankruptcy to obtain a fresh start.

Filing for bankruptcy prevents most creditors from pursuing legal action against you to collect a debt. Most debts discharge through bankruptcy, except for some tax liens and student loans.

Under a Chapter 7 bankruptcy, the court entirely writes off most debts. Individuals who don’t meet the qualifications for a Chapter 7 bankruptcy may file for Chapter 13.

Under Chapter 13 bankruptcy, the court discharges some debts, and other liabilities are reorganized through a payment plan. Individuals must adhere to a unique payment schedule with a Chapter 13 bankruptcy.

Filing for bankruptcy prevents debt collectors from pursuing legal action against you to collect a debt. Instead, they must comply with the rules of your bankruptcy and accept whatever payments the court orders you to make.

6. Court officers did not serve you properly

Under most state laws, a sheriff or officer of the court must deliver a court summons directly to you. If they fail to do so, you may argue that you never received the summons and were unaware of the lawsuit against you.

However, a defense of improper summons does not mean that the debt collector will not pursue further actions against you. The Affirmative Defense may help delay collection, but the creditor can always refile their lawsuit and ensure you receive the next summons.

7. You do not owe the money as an authorized user

Sometimes, people add authorized users to their credit cards or other financial accounts. Authorized users may pay the bill or review the account information. Usually, people add authorized users when another person handles the household finances or for transparency in their relationship.

Authorized users are not liable for paying off an old credit card debt. As long as they are not jointly responsible for the account, a debt collector cannot sue them to collect old balances.

8. The debt collector changed the balance

If a debt collector files a lawsuit against you to collect more than the original balance that you owed, you may have grounds to dispute the case. A debt collector cannot charge you more than the original balance; if they do, you must agree to the changes.

When you first receive notice from a debt collector that they are attempting to collect an old debt of yours, make sure you require them to validate the amount due. Compare it to your records. If it does not match and they attempt to sue you, you may use the documentation in your defense.

Use the right affirmative defense with ZumaZip

If you’re being sued for a debt, you must list any affirmative defenses in your initial response called the Answer. If you do not, you won’t be able to bring up these defenses later in the case, as outlined in the US Federal Rules of Civil Procedure, Rule 8(c), which states:

“(c) Affirmative Defenses.

(1) In General. In responding to a pleading, a party must affirmatively state any avoidance or affirmative defense, including:

- accord and satisfaction;

- arbitration and award;

- assumption of risk;

- contributory negligence;

- duress;

- estoppel;

- failure of consideration;

- fraud;

- illegality;

- injury by fellow servant;

- laches;

- license;

- payment;

- release;

- res judicata;

- statute of frauds;

- statute of limitations; and

- waiver.”

Understanding legal terms and affirmative defenses can indeed be daunting for most people. Fortunately, ZumaZip simplifies this process for you.

Here’s how it works: ZumaZip guides you through a series of questions about your case. Based on your responses, it automatically generates the affirmative defenses that are relevant to your situation. You don’t need to worry about deciphering legal jargon or figuring out which defenses to use. ZumaZip does the heavy lifting for you, ensuring that your Answer document includes the appropriate affirmative defenses in clear and understandable language. It streamlines the process, making it easier for you to navigate your defense in a debt collection lawsuit.

Make the right defense the right way with ZumaZip.

What is ZumaZip?

ZumaZip is your go-to solution for dealing with debt collectors.

With ZumaZip, you can:

Our Answer service is a step-by-step web application that guides you through the process. We ask you all the necessary questions to complete your Answer document accurately. Plus, once you’re done, our team will review your document with an attorney and file it for you.

ZumaZip streamlines the entire process, making it easier for you to handle debt collection matters effectively and confidently.