Facing a debt collection lawsuit can be overwhelming, but understanding the deadline to respond is crucial. In this guide, we’ll provide insights into the deadlines for filing your Answer in each state, empowering you to take timely action.

Understanding the Deadline:

When served with a debt collection lawsuit, you’re given a timeframe to respond by filing an Answer. This varies by state, ranging from 14 to 35 days. Missing the deadline can result in unfavorable consequences like a default judgment.

Navigating the Deadlines:

- Use the chart based on the date you were served to determine your deadline accurately.

- State-Specific Deadlines: Each state has its own timeline, so know yours to ensure compliance.

- Importance of Timely Response: Filing on time protects your rights and allows you to contest claims or negotiate a settlement.

Taking Action with ZumaZip:

ZumaZip streamlines the process, helping you draft and file your Answer quickly. With our platform, you can respond effectively and defend your interests.

Knowing your deadline is key to navigating debt collection lawsuits. Take action promptly, use resources like our calculator and ZumaZip, and protect your rights. Don’t delay – respond today!

The deadline to respond to the Summons in a debt collection lawsuit varies by state

Generally, most courts give the defendant 20-30 days to respond to Summons for debt collection, but the deadline varies. Below is an overview of the deadline to file an Answer in each of the 50 states.

As you will see, there is no uniform response time. This list does not document the nuances in each state such as certain case types or other factors. Keep in mind that laws are constantly changing, so make sure to double check your Summons document for your deadline.

Here’s a map depicting the table above, showing the time frame you have to respond to a debt collection lawsuit before losing by default. The darker the color, the quicker you need to respond.

Why You Want to Avoid a Default Judgment

If you fail to file your Answer within the relevant filing deadline, the debt collector will likely file a motion with the court asking it to enter a “default judgment” against you. Once a default judgment is entered, the debt collector is empowered to garnish your wages, seize your property, and even access the funds in your bank accounts. As you can see, this is not what you want to have happen when being pursued by a debt collector. You should take affirmative steps to respond to the Complaint. ZumaZip makes it easy to avoid a default judgment.

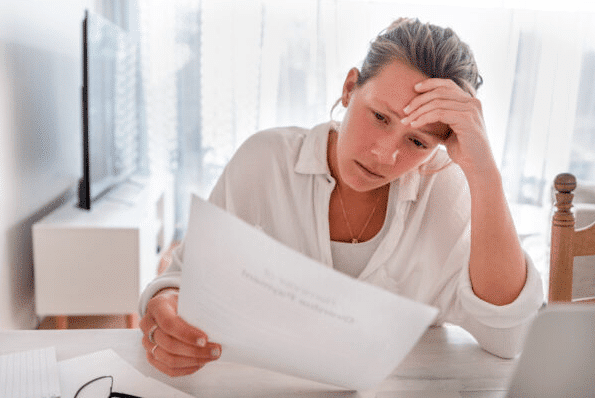

Getting served with a debt collection lawsuit is typically a stress and anxiety-inducing event for many people. Your mind may be inundated with questions and concerns. One of the first questions you may be asking yourself is, what is the deadline to respond to the debt collector complaint

Got served with a debt collection lawsuit? Here’s what you need to know:

- Don’t Ignore It: Ignoring the lawsuit won’t make it go away. Take it seriously and respond promptly.

- File Your Answer: You’ve got to file an Answer with the Clerk of Court before the deadline. This is your chance to tell your side of the story.

- Check Your Deadline: Every state has different deadlines for responding. Use ZumaZip’s summary to find out how many days you have to file your response.

By following these steps, you can protect your rights and navigate the debt collection process with confidence.

Don’t wait – take action now!