In Virginia, there isn’t a specific deadline to file a response to a debt lawsuit. However, it’s crucial to appear in court on the date specified in the Warrant In Debt if you wish to dispute the debt. To prepare for the court date, you can fill out a Grounds of Defense form and bring it with you. Additionally, using ZumaZip’s Answer form can help you bolster your case and assert any affirmative defenses you may have.

Navigating a debt collection lawsuit in Virginia can indeed feel daunting, especially when you’re already grappling with financial challenges. However, it’s crucial not to let stress paralyze you but rather empower yourself with knowledge and take proactive steps to address the situation.

In this guide, we’ll walk you through how to respond to a Summons for debt collection, known as a “Warrant In Debt” in Virginia. Despite its name, receiving this warrant doesn’t imply criminal charges but rather demands your attention to protect your financial interests. By understanding Virginia’s legal debt collection process and following the steps outlined here, you can navigate the process with greater confidence and clarity.

We’ll cover important topics such as state-specific deadlines, required forms, and filing fees to ensure you’re equipped to respond effectively to the lawsuit. Let’s delve into each step to help you navigate this challenging situation with ease and confidence.

Respond to the lawsuit before the Virginia deadline

While there is no deadline to respond to a debt lawsuit in Virginia, Virginia Code § 16.1-79 clearly states you must appear in court if you want to defend yourself in a debt lawsuit case:

“A civil action in a general district court may be brought by warrant directed to the sheriff or to any other person authorized to serve process in such county or city, requiring the person against whom the claim is asserted to appear before the court on a certain day, not exceeding sixty days from the date of service thereof, to answer the complaint of the plaintiff set out in the warrant. After the warrant has been issued and delivered for service it shall not be altered, nor any blank filled, except by order of the court.”

This entails that the plaintiff—the creditor or debt collector initiating the lawsuit—must arrange a court date within sixty days of serving the Warrant In Debt to the opposing party. Subsequently, the defendant—the individual being sued—must attend on that day to prevent a default judgment.

A default judgment signifies an automatic loss for you, granting the plaintiff the authority to garnish your wages or seize your property as a means to recover their funds.

So, if you want to avoid a default judgment and fight back against your Virginia debt lawsuit, you must prepare to appear in court on the date outlined in the Warrant In Debt. To prepare for your court date, you can fill out a Grounds of Defense and submit it to the court (or you can just wait to submit it in person).

Virginia Answer to Summons Forms

As mentioned above, Virginia does not require a formal “Answer” to be filed into the case before the court date. However, if you plan to dispute the debt, you must go to court and submit a Grounds of Defense document.

A Grounds of Defense gives you the opportunity to list your reasonings for why you should not be held liable for the debt. It is also a formal request for the plaintiff to submit a more detailed explanation of why you do owe it, known as a Bill of Particulars.

You can fill out this Grounds of Defense form and bring it with you to court on the date set forth by the Warrant In Debt. You may also consider submitting ZumaZip’s Answer form to help you strengthen your case and assert your affirmative defenses.

Answer Filing Fees for Virginia

One benefit of Virginia’s system is the absence of filing fees when responding to a Warrant In Debt. Yes, you read that correctly—no fees are required to submit a Grounds of Defense in Virginia.

However, while you save on filing expenses, you may find yourself incurring other costs such as travel expenses. Disputing a Warrant In Debt necessitates appearing before a judge on a designated date and time, typically indicated in the upper right-hand corner of the document received from the sheriff or process server.

What is a Virginia Warrant In Debt?

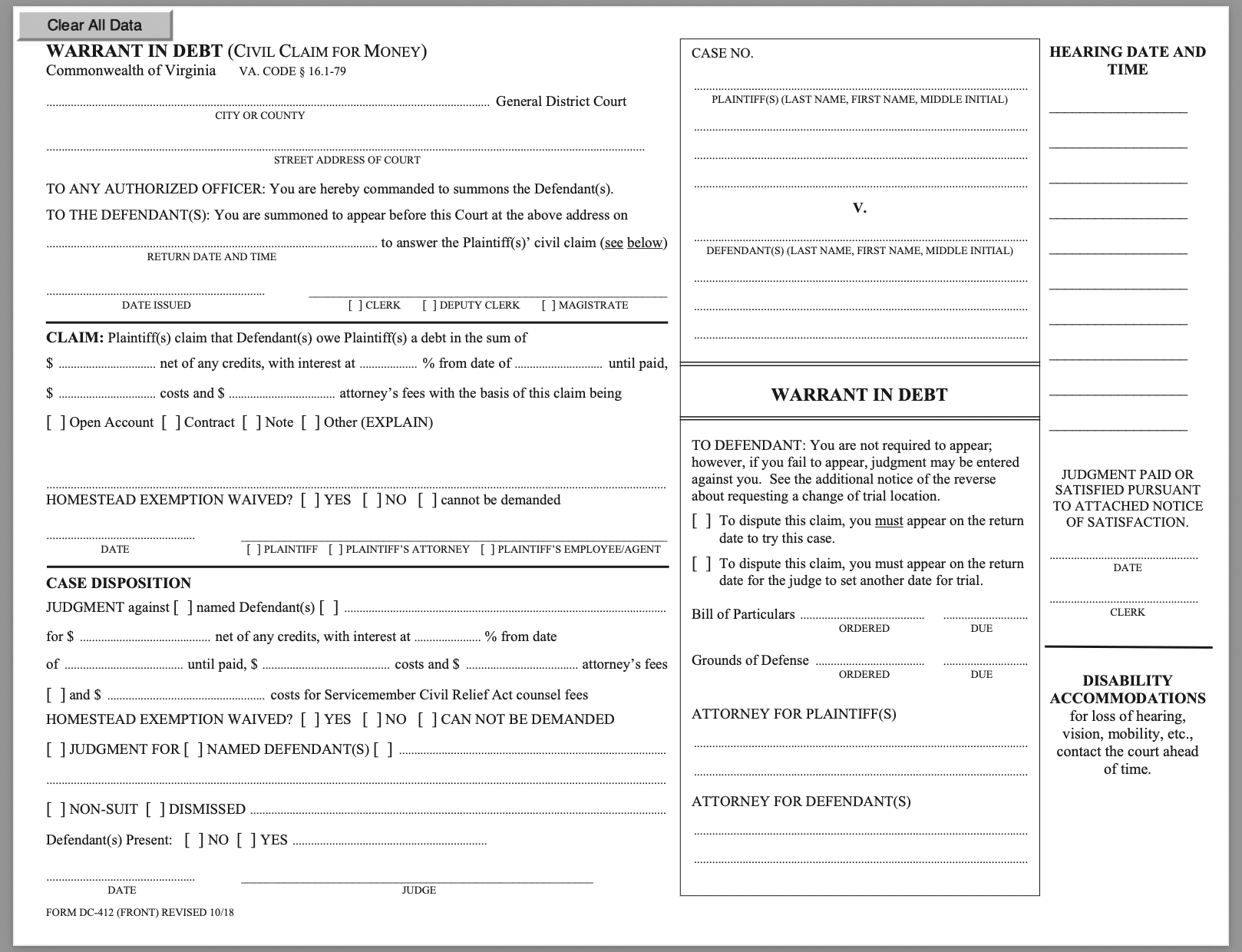

To initiate a debt collection lawsuit in Virginia, the debt collection company will need to fill out a document titled Warrant In Debt (Civil Claim for Money) and make arrangements to serve you with this document pursuant to Virginia Code § 16.1-79.

Not sure what a Warrant In Debt looks like? Here’s a Warrant In Debt form and example below:

Since the Warrant In Debt includes a section indicating you have the option not to appear in court, it has been referred to as an expedited motion for judgment. In effect, if someone ignores the Warrant in Debt and does not show up on the specified hearing date, the Warrant in Debt is essentially a motion for judgment for the debt collector.

So, a Virginia Warrant in Debt also serves as (1) a summons for the defendant to appear before the court on a specific date and time and (2) formal notice that if you fail to appear, a formal judgment could be entered against you for the amount the collector says you owe.

How to read a Warrant In Debt

If you have been served with a Warrant In Debt, it is quite common to not recognize the name of the debt collector or debt collection company. Why? Because many debts are sold, packaged, and even resold to other debt collectors and debt consolidation agencies.

This is why it is important to thoroughly review the warrant to make sure the information contained within the document is accurate. There is a chance that a random third-party debt collector filed a warrant with an incorrect amount owed or other inaccurate information.

While conducting your review, it is important to note that a Warrant In Debt in Virginia should contain the following information about the claim:

- The names of all relevant parties

- The city/county and address of the court where the warrant was filed and where you need to appear

- The date and time you are scheduled to appear before the court in order to dispute the amount allegedly owed. The date of the hearing is typically within sixty days of being served with the warrant

- The amount of the original debt owed including the interest rate and any claimed litigation cost and attorney’s fees sought by the plaintiff

- The type of debt owed: whether the amount owed is based on a contract, a mortgage or other financial note, or unpaid account balance

Respond to a Warrant In Debt in Virginia

When you get sued for debt in Virginia, you have options. For example, you can fight the case, ignore it, or try to settle. Below are some of the routes you might consider taking as a “response” to a debt collection lawsuit in Virginia:

Object to the venue of proceedings

If you have reason to believe the plaintiff (the person or company suing you) should have filed the Warrant In Debt in a different city or county, you have the right to file a written request to have the case moved to a different court. Virginia Code §8.01-264 states you must file a motion objecting to venue on or before your court date for it to be considered.

Let’s consider an example.

Example: Samuel lives in Virginia and recently moved from Richmond County to Arlington County. A few weeks after moving, Samuel receives a letter in the mail from the court. It is a Warrant In Debt stating that he is being sued by LVNV Funding in Richmond County. Since he no longer lives there, Samuel files a motion objecting to venue by mailing it to the courthouse listed on Warrant In Debt. A few weeks later, he learns the case has been dismissed and LVNV Funding will most likely file a new case in the correct court.

Appear in court to dispute the debt

You can appear before the judge on the designated date and time to dispute the amount owed. During the hearing, you can present evidence that you shouldn’t need to pay the amount allegedly owed. You also can request a trial and request that the plaintiff produce a Bill of Particulars.

Let’s look at another example.

Example: Jill was sued by Midland Credit Management for an old credit card debt in Virginia. She filled out a Grounds of Defense and appeared in court to dispute the claims. She also used ZumaZip to prepare an Answer to the lawsuit, which helped her understand which affirmative defenses would help her strengthen her case. After submitting the Grounds of Defense and Answer in the court, Midland Credit dismissed the case.

Settle the Warrant In Debt before your court date

After receiving a Warrant In Debt, exploring the option of settlement could prove advantageous. A judgment against you opens the door for wage garnishment and additional expenses, including filing and attorney fees. Therefore, engaging in mediation or negotiation for an out-of-court settlement could be a strategic move.

Many debt collectors, particularly those who have acquired debt for a fraction of its original value, are often open to settling for less than the full amount. Typically, debt buyers purchase old accounts for a mere 4% of the original sum. By settling for a reduced amount, you not only alleviate your financial burden but also prevent the debt buyer from reaping substantial profits at your expense.

ZumaZip Settle makes it easy to settle your debt and avoid going to court. Our software manages the settlement negotiation process for you and helps you get everything in writing.

And now, another example.

Example: Upon receiving a Warrant In Debt for $5,000, Brian decided to assess his financial situation thoroughly. He realized he could manage to settle $4,000 of his outstanding debts promptly with a lump-sum payment. Utilizing ZumaZip Settle, he initiated negotiations with the debt collector by proposing a settlement offer. After several rounds of discussions, they agreed upon a settlement amount of $3,500—equivalent to just 70% of the initial debt. This successful negotiation not only saved Brian money but also resulted in the dismissal of the case. With his financial obligations fulfilled and the legal matter resolved, Brian could finally breathe a sigh of relief.

Ignore the Warrant In Debt

Disregarding the Warrant In Debt is the most precarious choice as it effectively surrenders your defense, leading to an unfavorable ruling by the court. This adverse judgment typically encompasses accumulated interest, legal fees, and attorney costs, compounding your financial burden. Furthermore, once the judge issues an adverse judgment, your opportunity to challenge the debt’s validity diminishes, and this negative judgment reflects on your credit report. Thus, it’s crucial to consider the implications carefully before opting for this course of action.

Below is one final example.

For instance, consider Mary’s situation. When she faced a debt lawsuit in Virginia, the overwhelming nature of the situation led her to ignore it completely. Consequently, she failed to appear in court, resulting in a default judgment against her. Shortly thereafter, her wages began to be garnished. Mary’s ordeal could have been avoided had she responded to the lawsuit and attended the court proceedings.

What to expect from a Warrant In Debt trial in Virginia

During the hearing, it’s advisable to request a trial and a Bill of Particulars from the plaintiff.

Typically, the judge will schedule a trial date within three months following the hearing. This period offers an opportunity to craft a robust defense strategy demonstrating why you dispute the alleged debt. The Bill of Particulars, provided by the plaintiff, furnishes crucial details supporting their claim against you.

However, securing a trial date isn’t the only crucial step. Upon receiving the trial date, it’s imperative to file a Grounds of Defense promptly. This document outlines specific reasons why you contest the plaintiff’s claim. The judge will assign a deadline for filing your Grounds of Defense at the hearing, and adhering to this deadline is essential to your case.

It’s essential to recognize that Virginia’s legal system presents challenges favoring debt collectors in such cases. For instance, failure to attend the hearing specified in the Warrant In Debt may result in an adverse judgment. Similarly, admitting to owing money during the hearing or failing to file your Grounds of Defense on time could lead to an unfavorable judgment. Thus, thorough preparation and understanding of the legal process are crucial from start to finish.

Affirmative defenses to a Warrant In Debt can help you present a strong case

When drafting your Grounds of Defense, it is important to examine different affirmative defenses that can be asserted to challenge the Warrant In Debt. One of the strongest affirmative defenses is asserting that the plaintiff failed to file their lawsuit within the applicable statute of limitations. The statute of limitations defense is most likely viable when the alleged debt has been packaged and re-sold from one debt collector to another.

ZumaZip’s Answer form helps you determine which affirmative defenses are applicable to your case. This makes is a strong document to consider filing along with your Grounds of Defense.

The Virginia statute of limitations on debt is six years

In Virginia, the statute of limitations for most Warrant In Debt cases is typically six years. The six-year statute of limitations generally applies to most written contracts, oral contracts and open-ended accounts such as credit cards. This means that when a debt is more than six years overdue, then it is quite likely that a creditor can no longer attempt to collect the amount allegedly owed. The statute of limitations for a Warrant In Debt based on a promissory note is even shorter: five years.

Utilize Virginia legal aid organizations

Virginia has at least one government-funded organization that provides free legal services to people, in addition to other non-profits and public interest groups focused on assisting people who are being subjected to debt collection lawsuits. These organizations include:

Virginia Legal Aid Society

Phone (LawLine): 1-866-534-5243

434-455-3080 (for out-of-state numbers)

LawLine Intake Hours: 9am-3:30pm Monday, Tuesday, Thursday, and Friday.

National Association of Consumer Advocates

Phone: 202-452-1989

Fax: 202-452-0099

Virginia debt collection court locations

When it comes to debt collection lawsuits in Virginia, they will be filed in either a general district court or circuit court. There are general district courts and circuit courts in each city and county in Virginia.

The general district court is empowered to hear a variety of cases, including traffic violations and certain criminal cases. General district courts also possess exclusive authority to oversee civil cases with claims of $4,500 or less. General district courts also share authority with circuit courts to hear civil cases involving claims between $4,500 and $25,000. A Warrant In Debt is a civil claim. As a result, if you are being sued for an amount totaling $4,500 or less, the case will likely be filed in a general district court. If the amount allegedly owed is between $4,500 and $25,000, then the case could be filed in a general district court or a circuit court.

However, if the Warrant In Debt is seeking more than $25,000, then the case will be filed in a circuit court. This is because Virginia circuit courts handle all civil cases with claims of more than $25,000.

Takeaways

In short, here’s the review on how to answer a summons for debt collection, which is known as a Warrant In Debt, in Virginia:

Take these actions:

- If you agree with the amount owed, you should try to pay it off, if you can.

- If you dispute the amount owed, appear in court on the designated date and time. When the hearing commences, you should ask the judge for a trial and submit your Grounds of Defense.

- In addition to asking for a trial, you should request that the plaintiff produce a “Bill of Particulars.” The Bill of Particulars is a written document that the plaintiff will need to provide to you and the court showing that you owe money. Requesting a Bill of Particulars is important since it provides you with a general sense of how strong or weak the plaintiff’s case is against you.

What is ZumaZip?

ZumaZip is a convenient solution designed to streamline your response to a debt collection lawsuit. Here’s a breakdown of what you can expect when you use ZumaZip:

Firstly, you’ll access our user-friendly web application, which guides you through the process step by step. You’ll be prompted to answer a series of questions related to your specific situation. Once you’ve completed the questionnaire, you have the option to either print out the finalized forms and mail them to the appropriate courts yourself, or you can opt to utilize ZumaZip’s services to file them on your behalf. Additionally, if you choose this option, an attorney will review your document for added peace of mind.

If you’re seeking guidance on how to effectively respond to a debt collection lawsuit, ZumaZip can provide the assistance you need. Feel free to explore our FAQs for more information on what ZumaZip has to offer.

What if I haven’t been sued yet?

If you’ve only received a collections notice, but not a lawsuit, the best way to respond is with a Debt Validation Letter. When a debt collector contacts you in any way, whether it’s by phone or mail, you can respond by formally requesting a debt validation with a Debt Validation Letter . This letter notifies the collector that you dispute the debt and forces them to provide proof you owe the debt. They can’t call you or continue collecting until they provide validation of the debt. This flowchart shows how you can use a Debt Validation Letter to win.

Get started with a Debt Validation Letter here.

How to Answer a Summons for debt collection in all 50 states

Here’s a list of guides on how to respond to a debt collection lawsuit in each state:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont; Vermont (Small Claims court)

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Guides on how to beat every debt collector

Hey there! Facing off against a debt collector can feel like a daunting challenge, but fear not! We’re here to help you navigate through it all with our handy guides designed to assist you in beating every debt collector you encounter. Whether you’re facing a new lawsuit or dealing with a persistent collector, we’ve got your back. Stay positive, stay informed, and let’s tackle this together!

- Absolute Resolutions Investments LLC

- Accredited Collection Services

- Alliance One

- Amcol Clmbia

- American Recovery Service

- Asset Acceptance LLC

- Asset Recovery Solutions

- Associated Credit Services

- Autovest LLC

- Cach LLC

- Cavalry SPV I LLC

- Cerastes LLC

- Colinfobur

- Covington Credit

- Crown Asset Management

- CTC Debt Collector

- Cypress Financial Recoveries

- Delanor Kemper & Associates

- Eagle Loan of Ohio

- Educap

- Estate Information Services

- FIA Card Services

- Forster & Garbus

- Freshview Solutions

- Fulton Friedman & Gullace LLP

- Harvest Credit Management

- Howard Lee Schiff

- Hudson & Keyse LLC

- Integras Capital Recovery LLC

- Javitch Block

- Jefferson Capital Systems LLC

- LVNV Funding

- Mannbracken

- Mariner Finance

- Medicredit

- Michael J Adams PC

- Michael J Scott

- Midland Funding LLC

- Mullooly, Jeffrey, Rooney & Flynn

- Mountain Land Collections

- MRS Associates

- National Collegiate Trust

- Nationstar Foreclosure

- Northstar Capital Acquisition

- NCEP LLC

- NRC Collection Agency

- OneMain Financial

- Palisades Collection LLC

- Pallida LLC

- Paragon Revenue Group

- Pinnacle Collections Agency

- PMAB LLC

- Portfolio Recovery Associates

- Provest Law

- PYOD LLC

- Reunion Student Loan Finance Corporation

- Revenue Group

- Regents and Associates

- RSIEH

- Salander Enterprises LLC

- Second Round Sub LLC

- Security Credit Services

- Sherman Financial Group

- Suttell and Hammer

- T-Mobile

- Transworld Systems

- Tulsa Teachers Credit Union

- UCB Collection

- Velo Law Office

- Velocity Investments

- Waypoint Resource Group

- Weinberg and Associates

- Wolpoff & Abramson

Settle your medical debt

Having a health challenge is stressful, but dealing medical debt on top of it is overwhelming. Here are some resources on how to manage medical debt.

- Am I Responsible for My Spouse’s Medical Debt?

- Do I Need a Lawyer for Medical Bills?

- Do I Need a Lawyer to Fight Medical Bill Debt?

- Does Bankruptcy Clear Medical Debt?

- How Much Do Collection Agencies Pay for Medical Debt?

- How to Find Medical Debt Forgiveness Programs

- Is There a Statute of Limitations on Medical Bills?

- Medical Debt Statute of Limitations by State

- Summoned to Court for Medical Bills — What Do I Do?

- Summoned to Court for Medical Bills? What to Do Next

Stop calls from Debt Collectors

Do you keep getting calls from an unknown number, only to realize that it’s a debt collector on the other line? If you’ve been called by any of the following numbers, chances are you have collectors coming after you, and we’ll tell you how to stop them.