Going through a foreclosure is never easy, and sometimes you have the chance to challenge a foreclosure. Depending on the type of foreclosure you are facing, you will experience the process in a different way.

There are two main types of foreclosure, judicial and nonjudicial. It is a lot easier and less expensive to jump into a lawsuit with a judicial foreclosure. This is because you can go into the existing lawsuit, versus challenging a nonjudicial foreclosure. If your foreclosure is nonjudicial, it means it proceeds outside of the court system, and you will need to file a lawsuit to challenge the process.

Respond in 15 minutes with ZumaZip.

How to handle a foreclosure

Every foreclosure is different, and each state has its own procedures, but this is how you should go about challenging each type of foreclosure.

Contesting a judicial foreclosure

File a written Answer to the complaint (also known as the lawsuit). You will need to present your defenses and explain why the lender legally cannot foreclose on your home. This may need to include defenses for yourself against a motion for summary judgment and at trial. You should bring strong evidence that the lender or servicer made an error in the foreclosure procedures. This might include failing to send you a breach letter, initiating the foreclosure too soon, or not following state foreclosure procedures. In this case, you may be able to force the foreclosure to start over or look into a loan modification.

Contesting a non-judicial foreclosure

When contesting a non-judicial foreclosure, the process will happen outside of a court’s supervision. This means you will need to file an initial lawsuit to get the judge to look at your case. Opposite of a debt lawsuit, you will have the burden of proof because you want the judge to stop a proceeding. The proceeding will already have authorized the foreclosure that you signed when you took out the loan, so this is a bit more tricky.

Make the right defense the right way with ZumaZip.

How to fight a judicial foreclosure

In a judicial foreclosure, the foreclosing party is the lender, and they must file a lawsuit against you to begin the foreclosure process. When this begins you will be notified of the case by a summons and complaint, typically “served” to you. The documents will explain the lawsuit, the foreclosure as a whole, and give you a limited amount of time to respond. In this case, the lender will have the burden of proving to the judge that the foreclosure is valid and justified.

Ask for proof of the debt from the lender

The lender will typically need to provide all of the documents signed when taking out the initial loan in question. This might include refinancing papers, the mortgage (or deed of trust), and a promissory note. It may also include any notices sent to you or signed agreements as backup proof. Unless you respond with information regarding that there are errors in omissions in the paperwork or procedures, then the foreclosure will be accepted, and a default judgment will be placed against you.

Don’t ignore a debt collection lawsuit. Respond with ZumaZip.

How to file an answer

If you want to fight the foreclosure lawsuit, then you need to respond. This will give you the opportunity to state why the foreclosure is not legal, and you will need to do so between 20 to 30 days, or as specified on your summons.

This response needs to be filed in a specific method including format, responses to each claim, and your affirmative defenses. Never ad it to the lawsuit, so you should always deny or say you don’t have enough information to respond to that area.

You should also ask the lender to prove their claims including how many payments you have missed, the fees you owe, and anything else you want them to prove. If you admit fault, then they do not need to provide you with proof for that action. This is why you should never admit any responsibility.

The lender might then file a summary judgment motion after you file the answer. This is essentially asking the judge to decide the case without a trial. You can oppose this when submitting your arguments. You should also send your response to the other parties, and then show up to the hearing. If you do not have enough evidence as dictated by the court then the lender will win and the foreclosure will continue. If the judge denies the lender’s motion, the court will allow the case to proceed to trial.

Use ZumaZip to respond to debt collectors and win in court.

How to fight a non-judicial foreclosure in court

Because nonjudicial foreclosures proceed outside of court, you will need to be the one filing the suit in court. In this case, the burden of proof will rest with you because you will be the one looking to have the judge stop the proceeding of the foreclosure. This is already authorized which makes it even more tricky.

The next steps include the following:

- Make a motion for a temporary restraining order (TRO)

- Make a motion for a preliminary injunction to enjoin (stop) a foreclosure sale while your claims are being litigated.

- You can also ask the court for a permanent injunction.

When asking for a temporary restraining order, you will need to show that you will suffer “irreparable injury” if the foreclosure happens. Even if the lender does not respond, the judge will most likely grant this.

If you file for a preliminary injunction, all of your documents will be reviewed. You will need to show that the lender broke some type of law or the terms of the deed of trust. This is when you convince the judge that the foreclosure should be put on hold. You can use witnesses and facts to back up your case.

When to fight a foreclosure

It can be difficult to know when or when not to fight a foreclosure. If the lender obviously broke the law, then you should definitely fight the foreclosure in court. In addition to if you felt you were deprived of an important right. If you are judicial foreclosure and you have an argument that requires you to file another type of pleading to preserve your rights, you may not want to fight it. This can lead to more serious issues and lead to your loss of rights.

What is ZumaZip?

ZumaZip is a convenient solution designed to streamline your response to a debt collection lawsuit. Here’s a breakdown of what you can expect when you use ZumaZip:

Firstly, you’ll access our user-friendly web application, which guides you through the process step by step. You’ll be prompted to answer a series of questions related to your specific situation. Once you’ve completed the questionnaire, you have the option to either print out the finalized forms and mail them to the appropriate courts yourself, or you can opt to utilize ZumaZip’s services to file them on your behalf. Additionally, if you choose this option, an attorney will review your document for added peace of mind.

If you’re seeking guidance on how to effectively respond to a debt collection lawsuit, ZumaZip can provide the assistance you need. Feel free to explore our FAQs for more information on what ZumaZip has to offer.

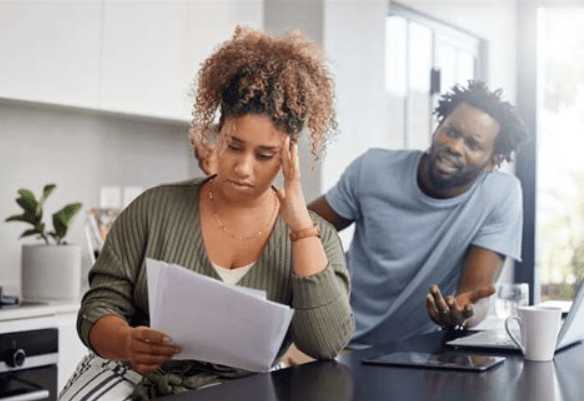

What if I haven’t been sued yet?

If you’ve only received a collections notice, but not a lawsuit, the best way to respond is with a Debt Validation Letter. When a debt collector contacts you in any way, whether it’s by phone or mail, you can respond by formally requesting a debt validation with a Debt Validation Letter . This letter notifies the collector that you dispute the debt and forces them to provide proof you owe the debt. They can’t call you or continue collecting until they provide validation of the debt. This flowchart shows how you can use a Debt Validation Letter to win.

Get started with a Debt Validation Letter here.

How to Answer a Summons for debt collection in all 50 states

Here’s a list of guides on how to respond to a debt collection lawsuit in each state:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont; Vermont (Small Claims court)

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Guides on how to beat every debt collector

Hey there! Facing off against a debt collector can feel like a daunting challenge, but fear not! We’re here to help you navigate through it all with our handy guides designed to assist you in beating every debt collector you encounter. Whether you’re facing a new lawsuit or dealing with a persistent collector, we’ve got your back. Stay positive, stay informed, and let’s tackle this together!

- Absolute Resolutions Investments LLC

- Accredited Collection Services

- Alliance One

- Amcol Clmbia

- American Recovery Service

- Asset Acceptance LLC

- Asset Recovery Solutions

- Associated Credit Services

- Autovest LLC

- Cach LLC

- Cavalry SPV I LLC

- Cerastes LLC

- Colinfobur

- Covington Credit

- Crown Asset Management

- CTC Debt Collector

- Cypress Financial Recoveries

- Delanor Kemper & Associates

- Eagle Loan of Ohio

- Educap

- Estate Information Services

- FIA Card Services

- Forster & Garbus

- Freshview Solutions

- Fulton Friedman & Gullace LLP

- Harvest Credit Management

- Howard Lee Schiff

- Hudson & Keyse LLC

- Integras Capital Recovery LLC

- Javitch Block

- Jefferson Capital Systems LLC

- LVNV Funding

- Mannbracken

- Mariner Finance

- Medicredit

- Michael J Adams PC

- Michael J Scott

- Midland Funding LLC

- Mullooly, Jeffrey, Rooney & Flynn

- Mountain Land Collections

- MRS Associates

- National Collegiate Trust

- Nationstar Foreclosure

- Northstar Capital Acquisition

- NCEP LLC

- NRC Collection Agency

- OneMain Financial

- Palisades Collection LLC

- Pallida LLC

- Paragon Revenue Group

- Pinnacle Collections Agency

- PMAB LLC

- Portfolio Recovery Associates

- Provest Law

- PYOD LLC

- Reunion Student Loan Finance Corporation

- Revenue Group

- Regents and Associates

- RSIEH

- Salander Enterprises LLC

- Second Round Sub LLC

- Security Credit Services

- Sherman Financial Group

- Suttell and Hammer

- T-Mobile

- Transworld Systems

- Tulsa Teachers Credit Union

- UCB Collection

- Velo Law Office

- Velocity Investments

- Waypoint Resource Group

- Weinberg and Associates

- Wolpoff & Abramson

Settle your medical debt

Having a health challenge is stressful, but dealing medical debt on top of it is overwhelming. Here are some resources on how to manage medical debt.

- Am I Responsible for My Spouse’s Medical Debt?

- Do I Need a Lawyer for Medical Bills?

- Do I Need a Lawyer to Fight Medical Bill Debt?

- Does Bankruptcy Clear Medical Debt?

- How Much Do Collection Agencies Pay for Medical Debt?

- How to Find Medical Debt Forgiveness Programs

- Is There a Statute of Limitations on Medical Bills?

- Medical Debt Statute of Limitations by State

- Summoned to Court for Medical Bills — What Do I Do?

- Summoned to Court for Medical Bills? What to Do Next

Stop calls from Debt Collectors

Do you keep getting calls from an unknown number, only to realize that it’s a debt collector on the other line? If you’ve been called by any of the following numbers, chances are you have collectors coming after you, and we’ll tell you how to stop them.