LVNV Funding is a legitimate debt collection agency that purchases old debt account at a fraction of the cost and contacts debtors to collect the full amount. If LVNV Funding has contacted you about a debt, Zumazip can help you respond before going to court.

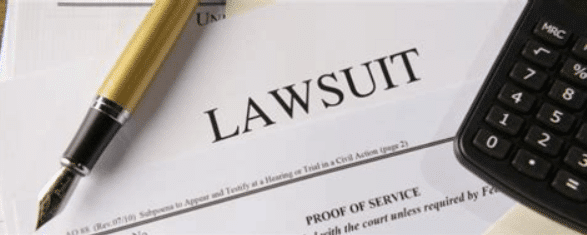

Have you been sued by LVNV Funding? But you have no idea who LVNV Funding is? You’re not alone. Many people who have defaulted on credit card debt or have fallen behind in student loan payments receive correspondence and are sometimes served with lawsuits from the debt collection company called LVNV Funding.

Getting a lawsuit can be confusing, stressful, and can cause you a lot of anxiety. But do not fear. There is a way to not only stand up against a debt collector like LVNV Funding but even beat them in court.

In this article, we are going to discuss what LVNV Funding is, whether it is a legitimate company overall, and what you need to do to fight back so that you are not at the mercy of LVNV Funding’s extensive resources.

Sued by LVNV Funding? Resolve your debt before going to court with ZumaZip Settle.

What is LVNV Funding?

LVNV Funding LLC is a company that specializes in debt collection. They typically acquire accounts that are in default from various creditors, such as credit card companies like Capital One, Chase, Citibank, Synchrony Bank, and Wells Fargo. For instance, if you’ve defaulted on payments for an Old Navy credit card serviced by Synchrony Bank, LVNV Funding might purchase your delinquent account along with others in a bundle from Synchrony Bank.

When you receive correspondence from LVNV Funding, it might be the first time you’ve heard of them, especially if you’re more familiar with the original creditor. However, this is simply because your account has been transferred to LVNV Funding for debt collection purposes. They may attempt to collect the debt from you directly or even pursue legal action if necessary.

Understanding the role of companies like LVNV Funding can help you navigate the debt collection process more effectively. If you find yourself in this situation, it’s essential to be aware of your rights and options when dealing with debt collectors.

Is LVNV Funding legitimate?

Yes, LVNV Funding, LLC is indeed a legitimate company with accreditation from the Better Business Bureau since 2017, boasting over 15 years of operation. However, it’s important to note that while LVNV Funding is formally incorporated as a limited liability corporation (LLC), its corporate structure is intentionally complex, often involving various related companies. This complexity serves to obscure assets and shield the company from liability, particularly when consumers raise concerns about potentially unethical debt collection practices.

As a typical player in the debt collection industry, LVNV Funding operates as a subsidiary within a network of related entities. Often categorized as a “junk debt buyer,” it purchases delinquent accounts in bulk at a fraction of their face value. While this business model can be profitable for such companies, it also raises questions about transparency and accountability in the debt collection process.

Understanding the intricacies of companies like LVNV Funding can empower consumers to make informed decisions when dealing with debt collection agencies and navigating the complexities of debt repayment.

Use ZumaZip to respond fast to junk debt buyers and win in court.

LVNV Funding, LLC reviews aren’t great

LVNV Funding has received hundreds of complaints on its Better Business Bureau (BBB) profile. Reviews consistently report that LVNV Funding violates the Fair Debt Collection Practices Act (FDCPA), so it makes sense that the company has a BBB rating of 1.13 out of 5 stars. Here are some real experiences that consumers have had in dealing with LVNV FUnding LLC:

These reported experiences with LVNV Funding highlight concerning practices within the debt collection industry:

- It’s distressing to hear about a consumer who diligently set up a debt payment plan with LVNV Funding, only to have the company abruptly cease retrieval of payments without notice. Ignoring attempts at communication from the consumer further compounds the frustration and uncertainty surrounding the situation.

- Cheena L.’s account underscores the challenges faced by individuals on disability benefits when dealing with debt collectors. LVNV Funding’s aggressive approach, including threats of seizing her car despite her limited income source, is not only harsh but also demonstrates a lack of empathy and understanding of her financial circumstances.

- Peter T.’s experience is deeply troubling, particularly amid the COVID-19 pandemic. Threatening someone’s life over a debt is completely unacceptable and goes beyond the bounds of ethical debt collection practices. Furthermore, the intimidation tactics used by LVNV Funding, leading to Peter T.’s failure to respond to the court summons, highlight the devastating impact such actions can have on individuals already under significant stress.

These accounts underscore the importance of ensuring that debt collection practices adhere to legal and ethical standards. Consumers facing similar situations should be aware of their rights and options, including seeking assistance from consumer protection agencies or legal professionals if necessary. Additionally, it’s crucial for regulatory bodies to investigate and address reported misconduct within the debt collection industry to protect consumers from such predatory practices.

LVNV Funding, LLC phone number and address

If LVNV Funding is contacting you about a debt that you don’t recognize, send them a Debt Validation Letter before they take the matter to court.

Many debt collection agencies simply give up after receiving such a letter, because it takes up their time, money, and resources to validate a debt. In some cases, they might not be able to validate the debt at all. To request a debt validation, you can use the following contact information:

- Physical Address: 55 Beattie Pl, Greenville, SC 29601

- Mailing Address: PO Box 10497, Greenville, SC 29603

- Phone number: (888) 665-0374

- Website: https://www.lvnvfunding.com

You can beat LVNV Funding in court—here’s how

Facing a legal battle with LVNV Funding in court? Here’s a guide to help you navigate through and potentially come out on top:

- Keep it Concise: Your Answer to the Summons and Complaint isn’t the platform to delve into a detailed narrative of your side of the story. Instead, focus on addressing the specific allegations against you.

- Deny, Deny, Deny: When drafting your Answer, don’t hesitate to deny any allegations that you believe are inaccurate or unjustified. This forces LVNV Funding to provide evidence to support their claims.

- Assert Affirmative Defenses: Alongside denials, consider including affirmative defenses in your Answer. These are legal arguments that, if proven, could undermine LVNV Funding’s case against you. Examples include statute of limitations or lack of standing.

- Stick to Standard Formatting: Ensure your Answer follows standard formatting or “style” as required by your jurisdiction. This helps maintain professionalism and clarity in your legal documents.

- Include Certificate of Service: Don’t forget to include a certificate of service with your Answer, indicating that you’ve provided a copy to LVNV Funding or their legal representative as required by court rules.

- Sign on the Dotted Line: Last but not least, make sure to sign your Answer. Your signature confirms the accuracy of the information provided and your acknowledgment of the legal proceedings.

By following these steps and seeking appropriate legal advice if necessary, you can effectively prepare your response to LVNV Funding’s lawsuit and potentially improve your chances of a favorable outcome in court.

Understand that LVNV Funding will likely not be able to prove a case against you.

Ignoring a lawsuit from LVNV Funding might seem tempting, but it’s crucial to understand the potential consequences and take proactive steps to protect yourself:

- Facing Consequences: Ignoring a lawsuit won’t make it disappear. LVNV Funding can obtain a judgment against you, leading to wage garnishment, other collection methods, and damage to your credit score.

- Chance to Win: By responding to the lawsuit instead of ignoring it, you have a significant opportunity to challenge LVNV Funding’s claims. Often, they lack sufficient evidence to prove their case, especially considering their dealings with numerous accounts.

- Demanding Proof: Simply asking LVNV Funding to provide proof that they own your debt and that it indeed belongs to you can prompt them to drop the case. Their lack of detailed information about your account may work in your favor.

- Protecting Your Rights: Responding to the lawsuit allows you to assert your rights and defend yourself against unjust claims. It’s essential to take an active role in the legal process to safeguard your interests.

Ultimately, facing a lawsuit from LVNV Funding requires a proactive approach. By responding and challenging their claims, you increase your chances of a favorable outcome and avoid the potentially severe consequences of ignoring the situation.

Respond to the lawsuit by immediately filing a written Answer

So, the way to respond to a lawsuit is to file an Answer within the allotted time. The deadline to respond is anywhere from 14-30 days depending on which state you live in. The court Summons should tell you how long you have to answer.

When you are drafting the Answer to the complaint, here are three tips to keep in mind:

- Offer No More Details Than Necessary. Do not use the Answer to tell a long story. All the court is looking for is whether you “admit” or “deny” the numbered paragraphs in the LVNV Funding complaint. So, simply say “admit” or “deny” for each paragraph.

- Only Admit What You Know is True. A big mistake from a lot of consumers when answering a debt collection lawsuit is saying “admit” to something that they do not know the answer to. For example, LVNV Funding might put in one paragraph that it “owns” your debt account. Do you know if that is true? No! All you know is that you got a credit card from Old Navy or some other store. Unless you have a document that proves that LVNV Funding owns your debt, then you say “deny” to that paragraph.

- Watch for Multiple Allegations in a Single Paragraph. Sometimes debt collectors like LVNV Funding try to get clever and put more than one fact into a single paragraph – like LVNV Funding owns your debt and you owe X dollars – hoping that you will “admit” to the whole thing. Don’t fall into that trap. Make sure that you “admit” or “deny” every single allegation, even if there are two or more in the same paragraph.

Answer a debt Complaint in minutes with ZumaZip.

To effectively protect yourself after receiving a lawsuit from LVNV Funding LLC, it’s crucial to respond appropriately. ZumaZip offers a convenient solution for filing your response with the court, streamlining the process for you.

In essence, the most effective strategy is to challenge the lawsuit by submitting your response. In many cases, debt buyers like LVNV Funding may lack the necessary documentation to substantiate their claims against you. By contesting the lawsuit, you increase the likelihood of a favorable outcome, potentially leading to the dismissal of the debt altogether.

With ZumaZip’s assistance, you can navigate the legal process with ease and take proactive steps to defend your rights.

Check to make sure LVNV Funding LLC isn’t a scam

Please ensure that LVNV Funding LLC is legitimate

It’s understandable to want to verify the authenticity of a company, especially when dealing with debt collection. While it’s uncommon for scammers to impersonate a reputable entity like LVNV Funding LLC, it’s always wise to exercise caution. Here are some tips to help you confirm the legitimacy of any calls or correspondence:

- Verify Information: LVNV Funding LLC should already possess your details, such as your address, phone number, and account information. Be wary if you’re asked to provide this information again.

- Ask Questions: Legitimate debt collectors should be able to provide details about the debt they claim you owe. If they’re evasive or refuse to answer questions, it may be a red flag.

- Request Identification: Ask for the caller’s employee ID number and company information. A genuine representative of LVNV Funding LLC will be able to provide this information readily.

By taking these precautions, you can help ensure that you’re dealing with the legitimate entity and protect yourself from potential scams.

Remember, you should never give out personal information if someone calls you about a debt. This is the best way to protect yourself. You can also avoid being scammed by sending asking the caller for the company address and sending in a Debt Validation Letter. If it’s a fake on the other line, they won’t be able to validate any debt and will avoid giving out address information.

What is ZumaZip?

ZumaZip is a convenient solution designed to streamline your response to a debt collection lawsuit. Here’s a breakdown of what you can expect when you use ZumaZip:

Firstly, you’ll access our user-friendly web application, which guides you through the process step by step. You’ll be prompted to answer a series of questions related to your specific situation. Once you’ve completed the questionnaire, you have the option to either print out the finalized forms and mail them to the appropriate courts yourself, or you can opt to utilize ZumaZip’s services to file them on your behalf. Additionally, if you choose this option, an attorney will review your document for added peace of mind.

If you’re seeking guidance on how to effectively respond to a debt collection lawsuit, ZumaZip can provide the assistance you need. Feel free to explore our FAQs for more information on what ZumaZip has to offer.

What if I haven’t been sued yet?

If you’ve only received a collections notice, but not a lawsuit, the best way to respond is with a Debt Validation Letter. When a debt collector contacts you in any way, whether it’s by phone or mail, you can respond by formally requesting a debt validation with a Debt Validation Letter . This letter notifies the collector that you dispute the debt and forces them to provide proof you owe the debt. They can’t call you or continue collecting until they provide validation of the debt. This flowchart shows how you can use a Debt Validation Letter to win.

Get started with a Debt Validation Letter here.

How to Answer a Summons for debt collection in all 50 states

Here’s a list of guides on how to respond to a debt collection lawsuit in each state:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont; Vermont (Small Claims court)

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Guides on how to beat every debt collector

Hey there! Facing off against a debt collector can feel like a daunting challenge, but fear not! We’re here to help you navigate through it all with our handy guides designed to assist you in beating every debt collector you encounter. Whether you’re facing a new lawsuit or dealing with a persistent collector, we’ve got your back. Stay positive, stay informed, and let’s tackle this together!

- Absolute Resolutions Investments LLC

- Accredited Collection Services

- Alliance One

- Amcol Clmbia

- American Recovery Service

- Asset Acceptance LLC

- Asset Recovery Solutions

- Associated Credit Services

- Autovest LLC

- Cach LLC

- Cavalry SPV I LLC

- Cerastes LLC

- Colinfobur

- Covington Credit

- Crown Asset Management

- CTC Debt Collector

- Cypress Financial Recoveries

- Delanor Kemper & Associates

- Eagle Loan of Ohio

- Educap

- Estate Information Services

- FIA Card Services

- Forster & Garbus

- Freshview Solutions

- Fulton Friedman & Gullace LLP

- Harvest Credit Management

- Howard Lee Schiff

- Hudson & Keyse LLC

- Integras Capital Recovery LLC

- Javitch Block

- Jefferson Capital Systems LLC

- LVNV Funding

- Mannbracken

- Mariner Finance

- Medicredit

- Michael J Adams PC

- Michael J Scott

- Midland Funding LLC

- Mullooly, Jeffrey, Rooney & Flynn

- Mountain Land Collections

- MRS Associates

- National Collegiate Trust

- Nationstar Foreclosure

- Northstar Capital Acquisition

- NCEP LLC

- NRC Collection Agency

- OneMain Financial

- Palisades Collection LLC

- Pallida LLC

- Paragon Revenue Group

- Pinnacle Collections Agency

- PMAB LLC

- Portfolio Recovery Associates

- Provest Law

- PYOD LLC

- Reunion Student Loan Finance Corporation

- Revenue Group

- Regents and Associates

- RSIEH

- Salander Enterprises LLC

- Second Round Sub LLC

- Security Credit Services

- Sherman Financial Group

- Suttell and Hammer

- T-Mobile

- Transworld Systems

- Tulsa Teachers Credit Union

- UCB Collection

- Velo Law Office

- Velocity Investments

- Waypoint Resource Group

- Weinberg and Associates

- Wolpoff & Abramson

Settle your medical debt

Having a health challenge is stressful, but dealing medical debt on top of it is overwhelming. Here are some resources on how to manage medical debt.

- Am I Responsible for My Spouse’s Medical Debt?

- Do I Need a Lawyer for Medical Bills?

- Do I Need a Lawyer to Fight Medical Bill Debt?

- Does Bankruptcy Clear Medical Debt?

- How Much Do Collection Agencies Pay for Medical Debt?

- How to Find Medical Debt Forgiveness Programs

- Is There a Statute of Limitations on Medical Bills?

- Medical Debt Statute of Limitations by State

- Summoned to Court for Medical Bills — What Do I Do?

- Summoned to Court for Medical Bills? What to Do Next

Stop calls from Debt Collectors

Do you keep getting calls from an unknown number, only to realize that it’s a debt collector on the other line? If you’ve been called by any of the following numbers, chances are you have collectors coming after you, and we’ll tell you how to stop them.