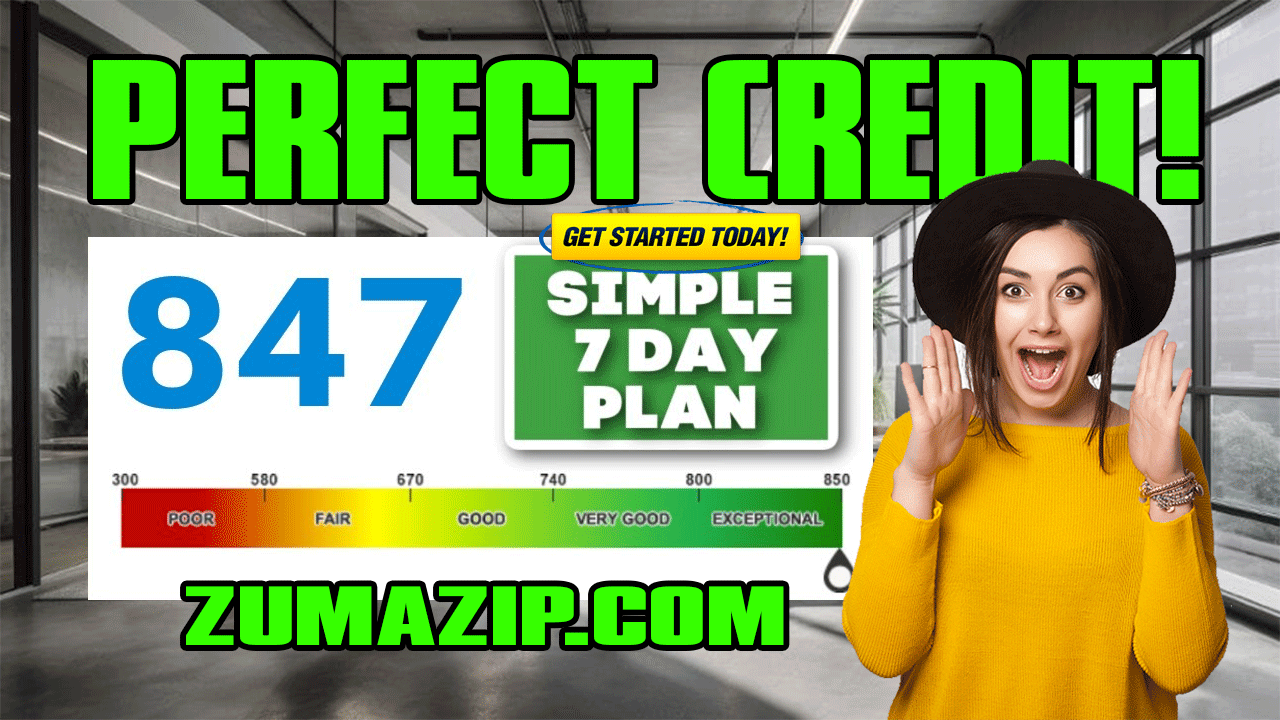

In an era where financial stability is paramount, ZumaZip.com is proud to announce the launch of its groundbreaking DIY Credit Repair Guide. Titled “Negotiating With Creditors | Settle Debt With Debt Collectors,” this guide is poised to revolutionize the way individuals take control of their financial well-being.

Navigating the complexities of debt negotiation and credit repair can be daunting, but with ZumaZip.com’s expertly crafted guide, it becomes an accessible and empowering journey. Whether you’re facing the challenges of managing debt, negotiating with creditors, or repairing your credit score, this comprehensive resource provides step-by-step strategies and invaluable insights to help you reclaim your financial freedom.

“At ZumaZip.com, we understand the importance of empowering individuals to take control of their financial future,” said Jason Brooks, at ZumaZip.com. “Our DIY Credit Repair Guide equips users with the knowledge and tools they need to negotiate effectively with creditors, settle debts, and ultimately achieve a healthier financial standing.”

Key features of the DIY Credit Repair Guide include:

- Proven strategies for negotiating with creditors and debt collectors

- Tips for crafting effective debt settlement offers

- Guidance on understanding and improving your credit score

- Insider secrets to navigating the credit repair process

Accessible online at ZumaZip.com, this guide is designed to demystify the world of credit repair and put the power back in the hands of consumers. Whether you’re a seasoned financial expert or a novice navigating the intricacies of debt management, ZumaZip.com’s DIY Credit Repair Guide is your ultimate companion on the path to financial success.

For more information or to access the DIY Credit Repair Guide, visit https://ZumaZip.com today.

About ZumaZip.com:

ZumaZip.com is a leading online resource dedicated to empowering individuals with the knowledge and tools they need to achieve financial freedom. From expert guides on debt management and credit repair to invaluable resources for budgeting and saving, ZumaZip.com is committed to helping users navigate the complexities of personal finance with confidence.

For more information about ZumaZip and its innovative solutions to Negotiating With Creditors | Settle Debt With Debt Collectors | DIY Credit Repair Guide, please visit ZumaZip.com

Additional Tools and Resources:

Beyond core services, ZumaZip offers supplementary tools like:

1. Debt Validation Letters

2. Motions to Compel Arbitration Empowering Users to Combat Creditor Harassment

3. Debt Settlement Negotiation Services

4. Reply & Answer Collection Letters

5. Stop Harassing Debt Collection Calls

6. 100’s of Resources and Information for Do it Yourself (aka DIY)

➡️ Video: https://www.youtube.com/watch?v=VZFAGxRQigw

What is ZumaZip?

ZumaZip is a convenient solution designed to streamline your response to a debt collection lawsuit. Here’s a breakdown of what you can expect when you use ZumaZip:

Firstly, you’ll access our user-friendly web application, which guides you through the process step by step. You’ll be prompted to answer a series of questions related to your specific situation. Once you’ve completed the questionnaire, you have the option to either print out the finalized forms and mail them to the appropriate courts yourself, or you can opt to utilize ZumaZip’s services to file them on your behalf. Additionally, if you choose this option, an attorney will review your document for added peace of mind.

If you’re seeking guidance on how to effectively respond to a debt collection lawsuit, ZumaZip can provide the assistance you need. Feel free to explore our FAQs for more information on what ZumaZip has to offer.

What if I haven’t been sued yet?

If you’ve only received a collections notice, but not a lawsuit, the best way to respond is with a Debt Validation Letter. When a debt collector contacts you in any way, whether it’s by phone or mail, you can respond by formally requesting a debt validation with a Debt Validation Letter . This letter notifies the collector that you dispute the debt and forces them to provide proof you owe the debt. They can’t call you or continue collecting until they provide validation of the debt. This flowchart shows how you can use a Debt Validation Letter to win.

Get started with a Debt Validation Letter here.

How to Answer a Summons for debt collection in all 50 states

Here’s a list of guides on how to respond to a debt collection lawsuit in each state:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont; Vermont (Small Claims court)

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Guides on how to beat every debt collector

Hey there! Facing off against a debt collector can feel like a daunting challenge, but fear not! We’re here to help you navigate through it all with our handy guides designed to assist you in beating every debt collector you encounter. Whether you’re facing a new lawsuit or dealing with a persistent collector, we’ve got your back. Stay positive, stay informed, and let’s tackle this together!

- Absolute Resolutions Investments LLC

- Accredited Collection Services

- Alliance One

- Amcol Clmbia

- American Recovery Service

- Asset Acceptance LLC

- Asset Recovery Solutions

- Associated Credit Services

- Autovest LLC

- Cach LLC

- Cavalry SPV I LLC

- Cerastes LLC

- Colinfobur

- Covington Credit

- Crown Asset Management

- CTC Debt Collector

- Cypress Financial Recoveries

- Delanor Kemper & Associates

- Eagle Loan of Ohio

- Educap

- Estate Information Services

- FIA Card Services

- Forster & Garbus

- Freshview Solutions

- Fulton Friedman & Gullace LLP

- Harvest Credit Management

- Howard Lee Schiff

- Hudson & Keyse LLC

- Integras Capital Recovery LLC

- Javitch Block

- Jefferson Capital Systems LLC

- LVNV Funding

- Mannbracken

- Mariner Finance

- Medicredit

- Michael J Adams PC

- Michael J Scott

- Midland Funding LLC

- Mullooly, Jeffrey, Rooney & Flynn

- Mountain Land Collections

- MRS Associates

- National Collegiate Trust

- Nationstar Foreclosure

- Northstar Capital Acquisition

- NCEP LLC

- NRC Collection Agency

- OneMain Financial

- Palisades Collection LLC

- Pallida LLC

- Paragon Revenue Group

- Pinnacle Collections Agency

- PMAB LLC

- Portfolio Recovery Associates

- Provest Law

- PYOD LLC

- Reunion Student Loan Finance Corporation

- Revenue Group

- Regents and Associates

- RSIEH

- Salander Enterprises LLC

- Second Round Sub LLC

- Security Credit Services

- Sherman Financial Group

- Suttell and Hammer

- T-Mobile

- Transworld Systems

- Tulsa Teachers Credit Union

- UCB Collection

- Velo Law Office

- Velocity Investments

- Waypoint Resource Group

- Weinberg and Associates

- Wolpoff & Abramson

Settle your medical debt

Having a health challenge is stressful, but dealing medical debt on top of it is overwhelming. Here are some resources on how to manage medical debt.

- Am I Responsible for My Spouse’s Medical Debt?

- Do I Need a Lawyer for Medical Bills?

- Do I Need a Lawyer to Fight Medical Bill Debt?

- Does Bankruptcy Clear Medical Debt?

- How Much Do Collection Agencies Pay for Medical Debt?

- How to Find Medical Debt Forgiveness Programs

- Is There a Statute of Limitations on Medical Bills?

- Medical Debt Statute of Limitations by State

- Summoned to Court for Medical Bills — What Do I Do?

- Summoned to Court for Medical Bills? What to Do Next

Stop calls from Debt Collectors

Do you keep getting calls from an unknown number, only to realize that it’s a debt collector on the other line? If you’ve been called by any of the following numbers, chances are you have collectors coming after you, and we’ll tell you how to stop them.

- 800-390-7584

- 800-289-8004

- 800-955-6600

- 877-366-0169

- 877-591-0747

- 800-278-2420

- 800-604-0064

- 800-846-6406

- 877-317-0948

- 888-899-4332

- 888-912-7925

- 202-367-9070

- 502-267-7522

Other wage garnishment resources

- Bank Account Garnishment and Liens in Texas

- Can I Stop Wage Garnishment?

- Can My Wife’s Bank Account Be Garnished for My Debt?

- Can Payday Loans Garnish Your Wages?

- Can pensions be garnished?

- Can Private Disability Payments Be Garnished?

- Can Social Security Disability Be Garnished?

- Can They Garnish Your Wages for Credit Card Debt?

- Can You Stop a Garnishment Once It Starts?

- Guide to Garnishment Limits by State

- How Can I Stop Wage Garnishments Immediately?

- How Long Before a Creditor Can Garnish Wages?

- How Long Does It Take to Get Garnished Wages Back?

- How to Fight a Wage Garnishment

- How to Prevent Wage Garnishment

- How to Stop a Garnishment

- How to Stop Social Security Wage Garnishment

- How to Stop Wage Garnishment — Everything You Need to Know

- New York Garnishment Laws – Overview

- Ohio Garnishment Laws — What They Say

- Wage Garnishment Lawyer

- What Is Wage Garnishment?

Guides on Arbitration

If the thought of going to court stresses you out, you’re not alone. Many Americans who are sued for credit card debt utilize a Motion to Compel Arbitration to push their case out of court and into arbitration.

Below are some resources on how to use an arbitration clause to your advantage and win a debt lawsuit.

- How Arbitration Works

- How to Find an Arbitration Clause in Your Credit Agreement

- How to Make a Motion to Compel Arbitration

- How to Make a Motion to Compel Arbitration in Florida

- How to Make a Motion to Compel Arbitration Without an Attorney

- How Credit Card Arbitration Works

- Motion to Compel Arbitration in California

- Sample Motion to Compel Arbitration

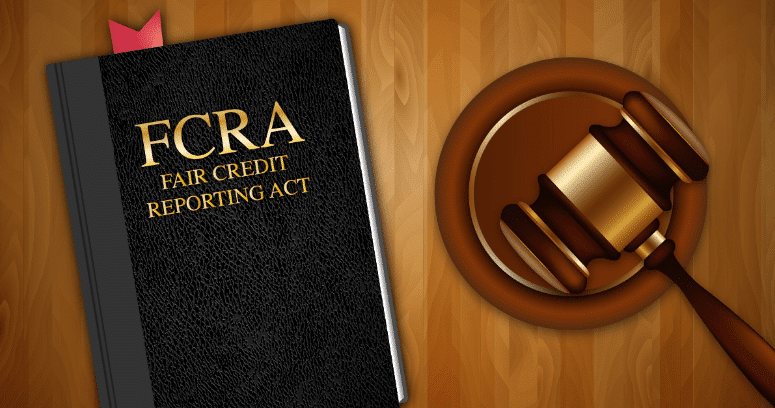

Federal Debt Collection Laws Can Protect You

Knowing your rights makes it easier to stand up for your rights. Below, we’ve compiled all our articles on federal debt collection laws that protect you from unfair practices.

- 15 USC 1692 Explained

- Does the Fair Credit Reporting Act Work in Florida?

- FDCPA Violations List

- How to File an FDCPA Complaint Against Your Debt Collector (Ultimate Guide)

- How to Make a Fair Debt Collection Practices Act Demand Letter

- How to Submit a Transunion Dispute

- How to Submit an Equifax Dispute

- How to Submit an Experian Dispute

- What Debt Collectors Cannot Do — FDCPA Explained

- What Does Account Information Disputed by Consumer Meets FCRA Requirements Mean?

- What does “meets FCRA requirements” mean?

- What does FCRA stand for?

- What is the Consumer Credit Protection Act

Resolve Your Debt with Your Creditor

Some creditors, banks, and lenders have an internal collections department. If they come after you for a debt, ZumaZip can still help you respond and resolve the debt. Here’s a list of guides on how to resolve debt with different creditors.

- American Express; American Express – Debt Collection

- Bank of America

- Barclay

- Best Buy Credit Card

- Capital One

- Chase

- Credit One Bank

- Old Navy Credit Card

- PayPal Synchrony Card

- Regional Finance

- Retailers National Bank

- Reunion Student Loan Finance Corporation

- SYNCB/PPEXTR

- Synchrony Bank

- Synchrony Walmart Card

- Target National Bank

- Webbank

- Wells Fargo

- Can I Pay My Original Creditor Instead of a Debt Collection Agency?

- Can I Settle a Debt with the Original Creditor?